You're evaluating risk assessment and proposal software for your RIA or independent practice. Nitrogen (formerly Riskalyze) has been the established player in risk-scoring and client engagement for years. But you've heard about newer platforms promising end-to-end workflows that go beyond risk tolerance. If you're wondering whether Nitrogen's risk-first approach or Investipal's complete intake-to-portfolio workflow is the better fit, this detailed comparison will help you decide.

TL;DR: Key Differences at a Glance

- Nitrogen (Riskalyze) excels at risk scoring, risk-aligned proposals, and client check-ins. It's a proven solution if your primary goal is risk communication and engagement.

- Investipal offers an end-to-end workflow from statement scanning and data intake through proposal generation, IPS/Reg BI compliance documentation, and ongoing portfolio management - all in one unified platform.

- Core trade-off: Nitrogen is a best-in-class point solution for risk assessment and proposals. Investipal is a complete workflow platform that embeds risk assessment within a broader intake-to-compliance-to-portfolio pipeline.

- If you need statement OCR, automated IPS/Reg BI generation, and portfolio operations continuity beyond the initial proposal, Investipal may reduce your total tool count and streamline onboarding.

What is Nitrogen (Riskalyze)?

Nitrogen, formerly known as Riskalyze, pioneered the "Risk Number" approach to quantifying client risk tolerance. The platform helps advisors assess client risk preferences, build risk-aligned portfolios, generate proposals that communicate risk clearly, and conduct ongoing client check-ins to ensure alignment over time.

Nitrogen's core strengths include:

- Proprietary Risk Number scoring system

- Risk-aligned portfolio modeling and stress testing

- Client-facing proposals with risk/return visualizations

- Periodic risk check-ins and engagement tools

- Integrations with custodians and CRMs

For advisors whose primary pain point is communicating portfolio risk to clients in a clear, repeatable way, Nitrogen has proven valuable. While Nitrogen does offer statement scanning and IPS generation capabilities, these workflows are not as deeply integrated as Investipal's unified approach. Nitrogen does not include client onboarding workflows or Reg BI compliance documentation.

What is Investipal?

Investipal is a unified wealth management platform designed to automate the complete advisor workflow from client intake through portfolio management. Rather than focusing on a single capability like risk scoring, Investipal integrates statement scanning, risk assessment, proposal generation, compliance documentation (IPS and Reg BI), and ongoing portfolio operations into one end-to-end system.

Investipal's core capabilities include:

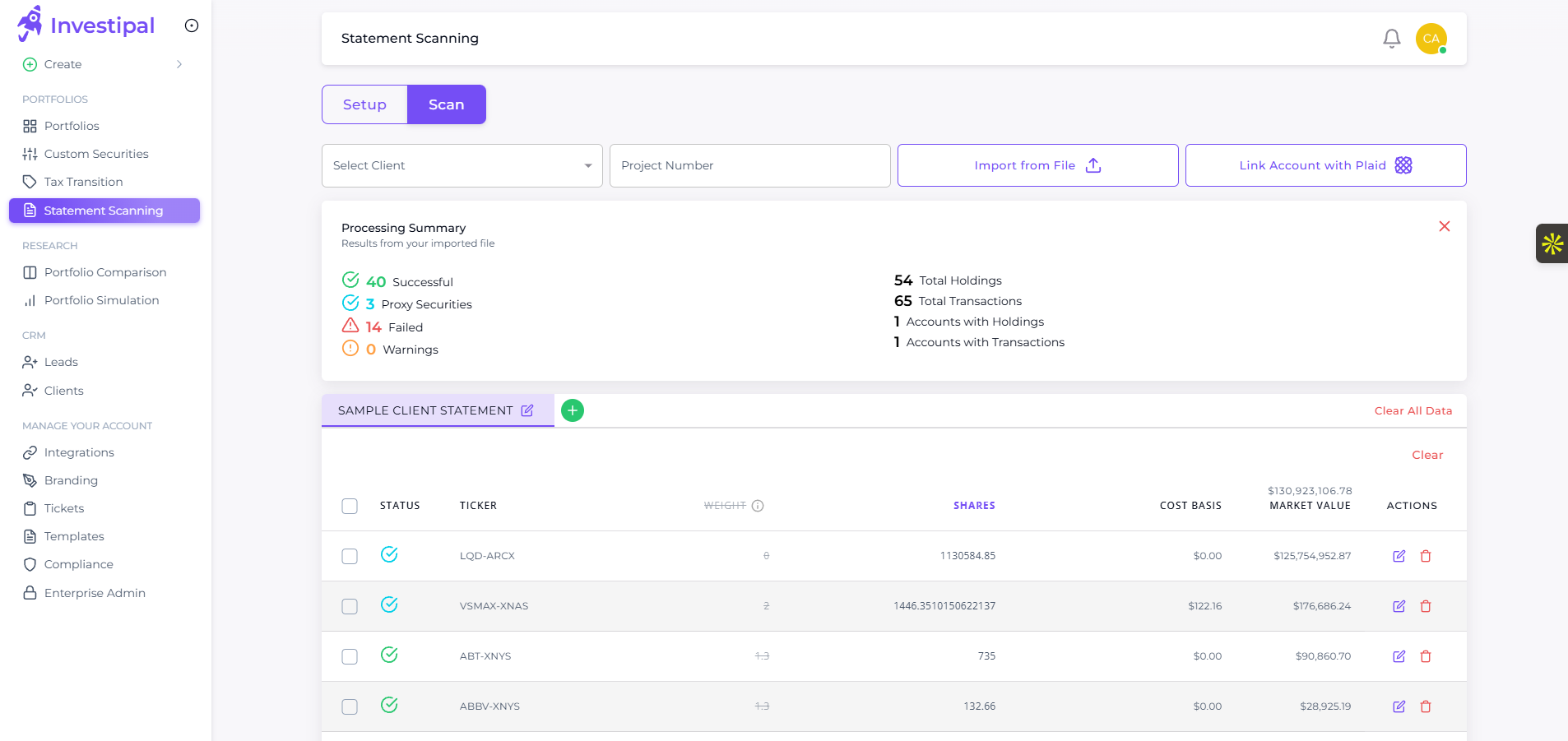

- AI-powered brokerage statement scanning (OCR) to extract portfolio data from PDFs

- Risk tolerance assessment integrated into client intake

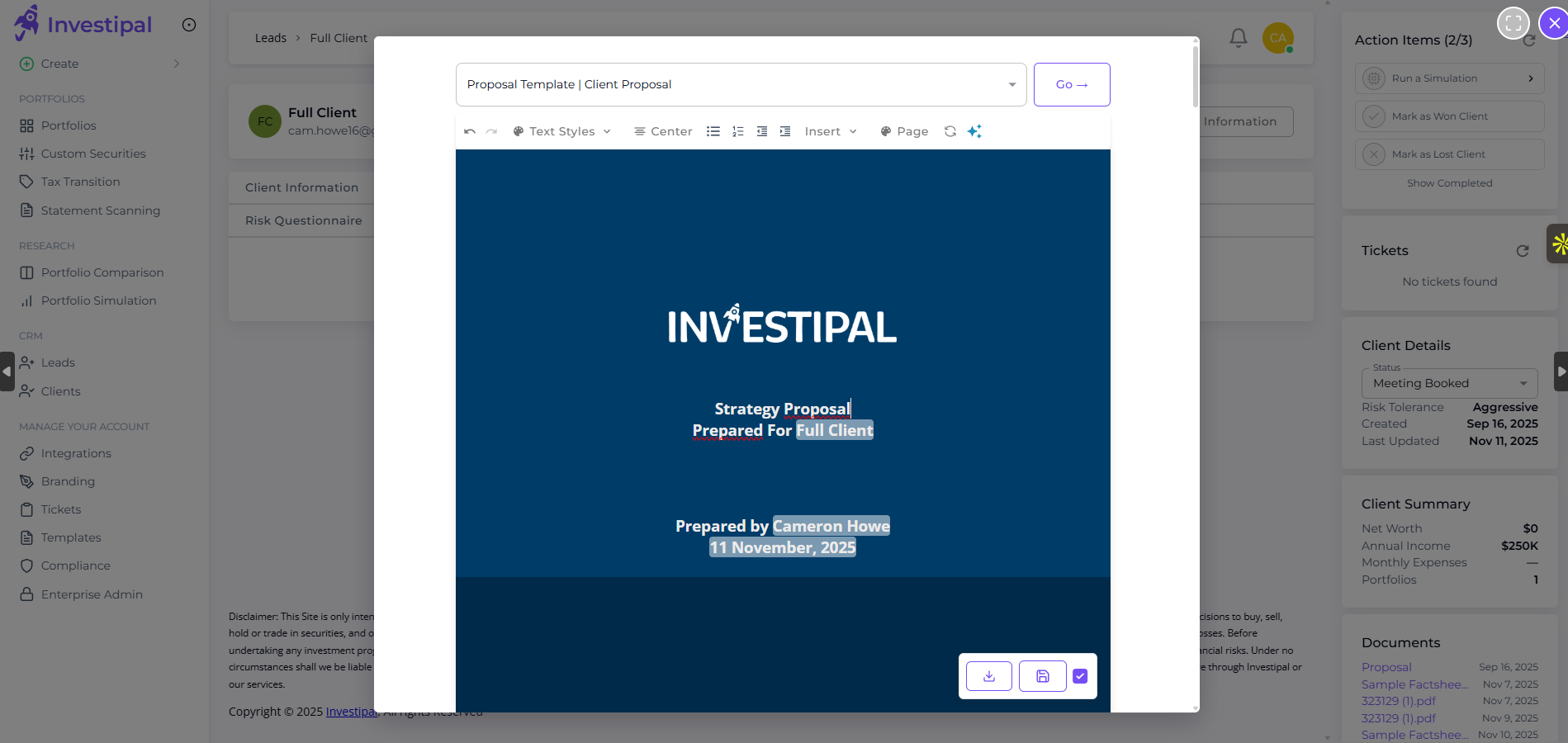

- Automated proposal generation with side-by-side current vs. proposed portfolios

- Automated IPS and Reg BI compliance documentation

- Portfolio construction, optimization, and ongoing drift monitoring

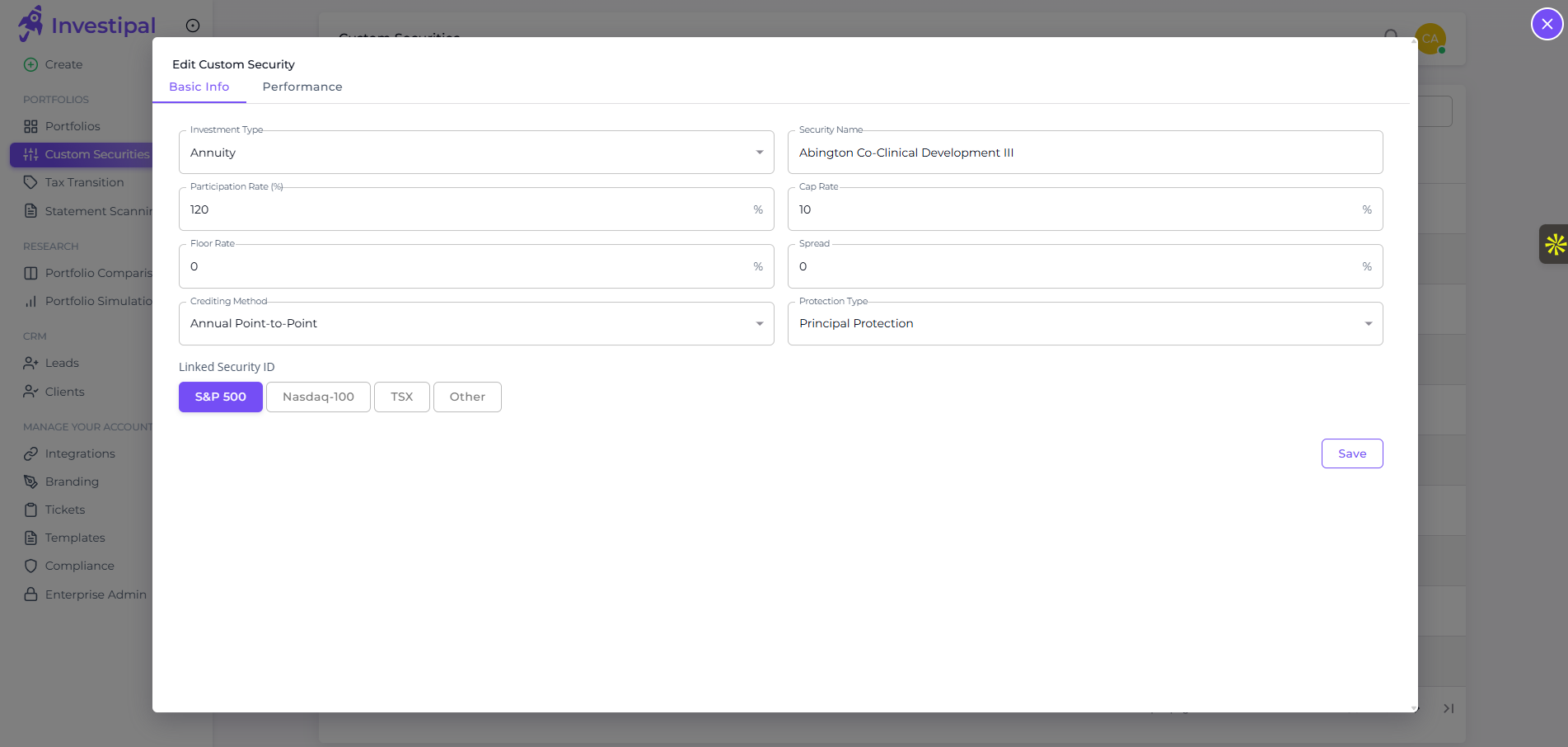

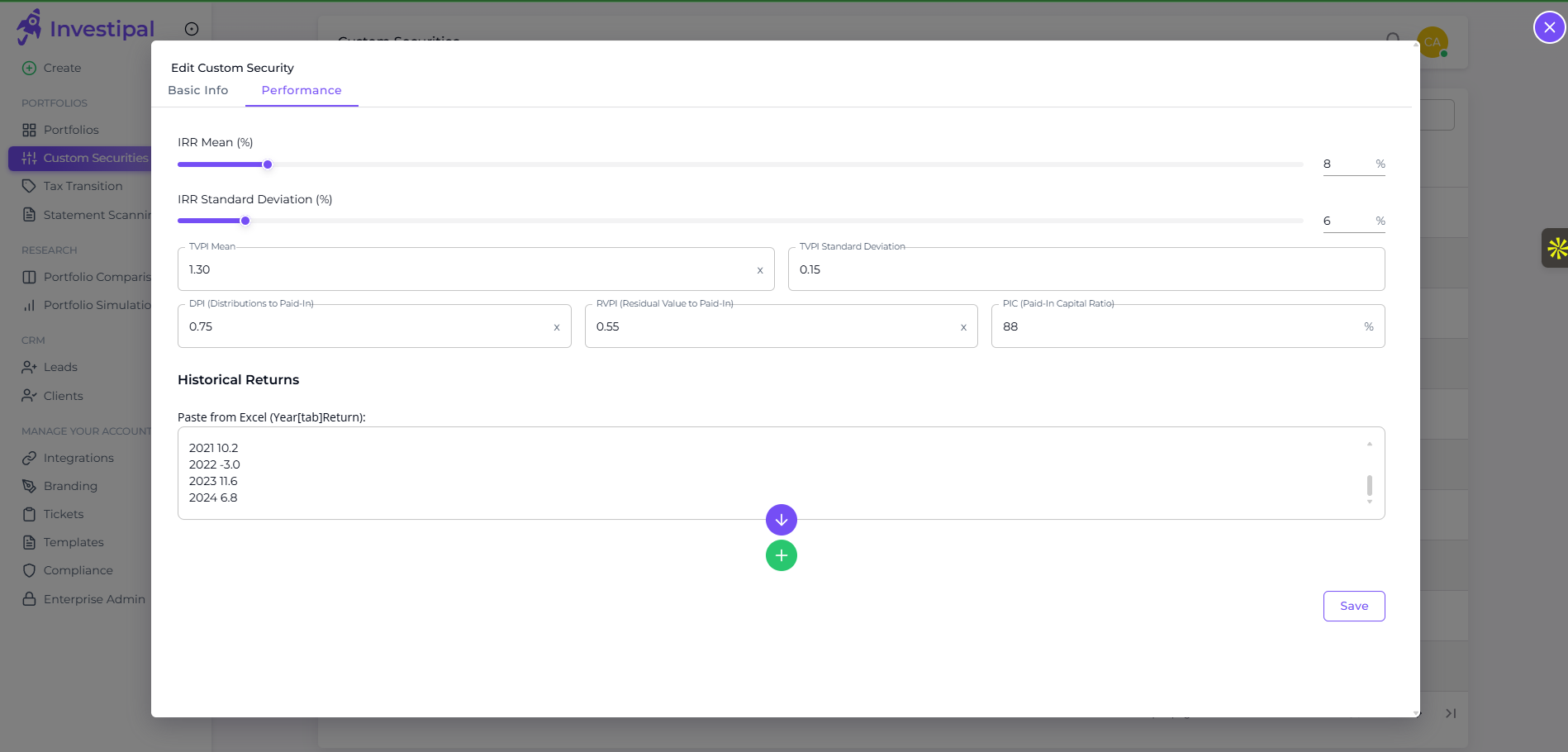

- Support for alternative investments and custom securities

Investipal is built for advisors and RIAs looking to reduce manual data entry, consolidate their tech stack, and generate both client-facing proposals and compliance documentation from a single data source.

Feature-by-Feature Comparison

Below is a direct comparison of key features across both platforms:

| Feature | Nitrogen (Riskalyze) | Investipal |

|---|---|---|

| Risk Assessment | ✅ Proprietary Risk Number; questionnaire-based | ✅ 3-factor risk assessment (behavioral, capacity, portfolio-driven) |

| Brokerage Statement Scanning (OCR) | ⚠️ Basic statement scanning; limited format support | ✅ Advanced AI-powered OCR supporting 50+ brokerage formats, handwritten notes, and complex multi-page statements |

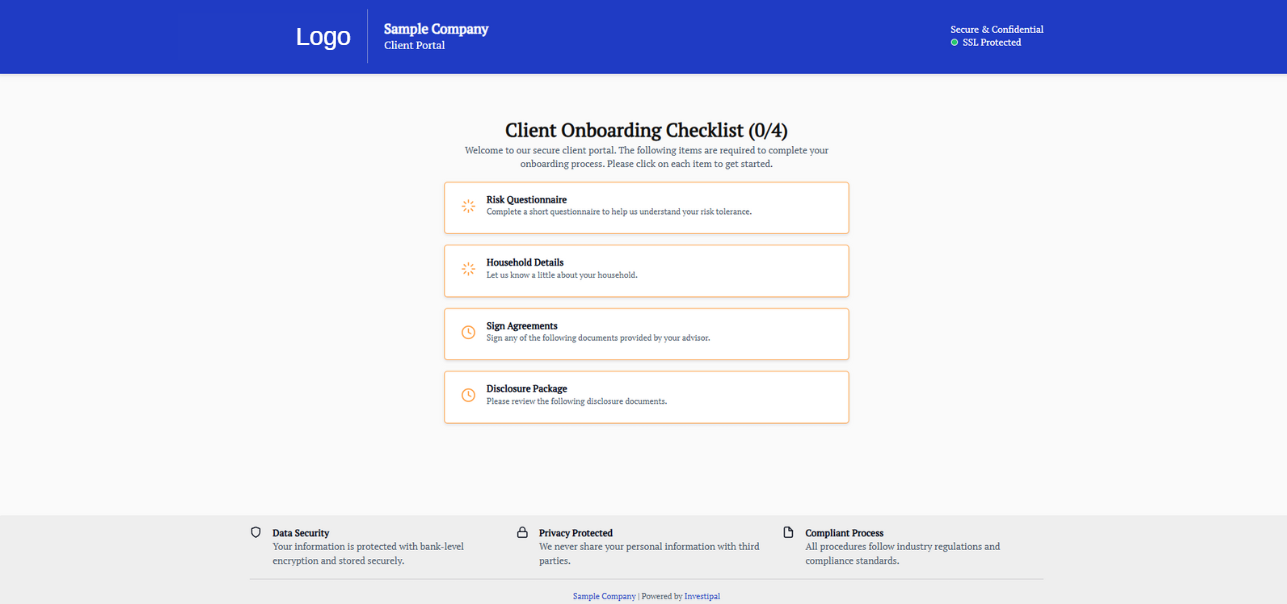

| Client Onboarding Workflows | ❌ Not included; requires separate onboarding tools | ✅ Complete digital onboarding with e-signature, ID verification, and account opening workflows |

| Proposal Generation | ✅ Risk-aligned proposals with stress testing and visualizations | ✅ Side-by-side current vs. proposed portfolios with risk, allocation, and tax analysis |

| IPS Generation | ⚠️ Available but requires separate workflow from proposals | ✅ Automated IPS generated from same data source as proposals in one unified workflow |

| Reg BI Compliance Documentation | ❌ Not included | ✅ Automated Reg BI disclosures and compliance workflows |

| Portfolio Construction & Optimization | ✅ Risk-based optimization; limited multi-asset support | ✅ Multi-asset portfolio construction including alternatives, custom securities, and explainable AI optimization |

| Ongoing Portfolio Management | ✅ Risk check-ins and drift alerts | ✅ Drift monitoring, rebalancing workflows, and portfolio analytics |

| Held-Away Asset Aggregation | ⚠️ Limited; depends on custodian integrations | ✅ Native statement scanning supports held-away accounts |

| Alternative Investments & Custom Securities | ⚠️ Limited support | ✅ Full support for alts modeling and custom asset classes |

| Client-Facing Engagement Tools | ✅ Risk check-ins, stress tests, client portals | ✅ Portfolio dashboards, reporting, and client communication |

| CRM & Custodian Integrations | ✅ Extensive integrations | ✅ Key integrations with advisor CRMs and custodians |

Workflow Comparison: Onboarding a New Client

The biggest difference between Nitrogen and Investipal becomes clear when you map out the complete new client workflow.

Typical Workflow with Nitrogen (Riskalyze)

- Collect Client Statements: Advisor uses Nitrogen's statement scanning (limited format support) or custodian feed.

- Risk Assessment: Client completes Nitrogen Risk Number questionnaire.

- Build Portfolio: Advisor uses Nitrogen to model risk-aligned portfolio and run stress tests.

- Generate Proposal: Nitrogen produces risk-focused proposal with visualizations.

- Create IPS (Separate Workflow): Advisor switches to Nitrogen's IPS module to create Investment Policy Statement separately from the proposal workflow.

- Reg BI Documentation (Separate Tool): Advisor documents Reg BI compliance using external tools.

- Client Onboarding (Separate Tool): Advisor uses separate e-signature and onboarding software to complete account opening.

- Portfolio Management (Separate Tool): Advisor uses portfolio management software for ongoing operations.

Result: Multiple workflows and tools, context switching between modules. Total time to proposal + IPS: 30-60+ minutes depending on complexity.

Typical Workflow with Investipal

- Upload Client Statements: Advisor uploads PDF statements; AI OCR extracts all holdings automatically.

- Integrated Risk Assessment: Client completes risk questionnaire; data syncs with parsed portfolio.

- Build Portfolio: Advisor uses Investipal to construct proposed portfolio with risk, tax, and allocation analysis.

- Generate Proposal + IPS + Reg BI (One Step): Investipal produces proposal, IPS, and Reg BI documentation from the same data source in minutes.

- Onboarding & Portfolio Management (Same Platform): Portfolio transitions seamlessly into ongoing drift monitoring and rebalancing workflows.

Result: Unified workflow, no re-keying, compliance documentation generated alongside proposal. Total time to proposal + IPS: minutes in typical workflows.

Key Differentiators: Where Investipal Stands Out

1. More Robust Statement Scanning for Complex Formats

While Nitrogen does offer statement scanning capabilities, it has limited format support compared to Investipal. Investipal's advanced AI-powered OCR is trained on 50+ brokerage statement formats and can handle complex multi-page statements, handwritten notes, and non-standard layouts that other scanners struggle with.

This means fewer failed scans, less manual cleanup, and the ability to work with prospects holding accounts at smaller custodians or international brokerages. For advisors dealing with complex held-away portfolios, Investipal's scanning accuracy reduces onboarding friction significantly.

2. Unified Workflow for Proposals and Compliance Documentation

Nitrogen does offer IPS generation, but it requires switching to a separate module and workflow after creating proposals. This means re-entering or confirming client data and investment parameters in a different part of the platform.

Investipal generates proposals, IPS, and Reg BI disclosures from the same data source in one unified workflow. Once you've scanned statements and built a proposed portfolio, all compliance documentation is created simultaneously without switching modules or re-entering data. This reduces compliance lag, ensures consistency between documents, and saves time. Learn more about automated IPS generation and Reg BI workflows.

3. Complete Client Onboarding Workflows

Nitrogen does not include client onboarding capabilities such as e-signature, identity verification, or account opening workflows. After a client accepts a proposal, advisors must use separate onboarding tools to complete paperwork and open accounts.

Investipal includes complete digital onboarding workflows with e-signature, ID verification, and guided account opening. This means the transition from proposal acceptance to funded account happens within the same platform, reducing friction and improving the client experience.

4. End-to-End Workflow Continuity

Nitrogen focuses primarily on the pre-sale and proposal stage. Once a client signs, advisors typically move to separate portfolio management software for rebalancing, reporting, and ongoing operations.

Investipal supports the complete lifecycle: prospect intake → proposal → compliance → onboarding → ongoing portfolio management. This continuity reduces tool sprawl, data silos, and operational drag as your practice scales.

5. Support for Alternative Investments and Complex Portfolios

Nitrogen's portfolio construction is optimized for traditional equities and bonds. Advisors working with HNW clients who hold private equity, real estate, annuities, or other alternative assets often find Nitrogen's modeling limited.

Investipal includes a Custom Security Builder that allows advisors to model alternatives, structured products, and non-standard assets within the same portfolio optimization engine. This is especially valuable for wealth managers serving complex households.

Key Differentiators: Where Nitrogen Stands Out

1. Established Risk Number Brand Recognition

Nitrogen's Risk Number has strong brand recognition in the advisor community. Many advisors appreciate the simplicity of explaining risk as a single number, and clients often respond well to the visual stress tests and risk communication tools Nitrogen provides.

If your practice is built around the Risk Number methodology and your clients know and expect it, switching platforms may require re-education.

2. Mature Integration Ecosystem

Nitrogen has been in the market longer and offers a broad range of integrations with CRMs, custodians, and financial planning software. If your tech stack is deeply integrated with Nitrogen, migration may involve coordination across multiple systems.

3. Client Engagement & Check-In Tools

Nitrogen has invested heavily in client engagement features like periodic risk check-ins, stress test updates, and market commentary. These tools are designed to keep clients engaged and confident during volatile markets.

Investipal offers portfolio monitoring and reporting, but Nitrogen's engagement-focused features may be more robust for practices prioritizing ongoing client touchpoints.

Pricing and ROI Considerations

Both platforms typically price based on the number of advisors, households, or AUM. Specific pricing is usually customized based on firm size and feature requirements. According to industry research, advisor technology spending has increased significantly as firms seek to improve operational efficiency and client experience.

Nitrogen pricing generally includes risk assessment, proposals, and client engagement features. Additional costs may arise from separate tools needed for statement aggregation, IPS generation, and portfolio management software.

Investipal pricing reflects an all-in-one platform. When evaluating ROI, consider the cost of tools Investipal replaces: statement aggregation software, IPS generators, separate portfolio management systems, and compliance documentation tools. In many cases, consolidating these workflows into one platform reduces total software spend while improving operational efficiency.

For detailed pricing and a custom ROI calculation for your firm, book a demo with Investipal.

Who Each Solution is Best For

Choose Nitrogen (Riskalyze) if:

- Your primary focus is risk communication and client engagement around risk tolerance

- You already have strong statement aggregation and portfolio management tools in place

- You prefer a proven, established platform with extensive integrations

- Your clients know and expect the Risk Number methodology

- You don't need IPS or Reg BI automation and handle compliance separately

Choose Investipal if:

- You want to consolidate multiple tools into one end-to-end workflow

- You need automated statement scanning (OCR) to eliminate manual data entry

- You want IPS and Reg BI documentation generated alongside proposals

- You work with complex portfolios including alternatives and custom securities

- You value workflow continuity from prospect intake through ongoing portfolio management

- You're looking to reduce total tool count and streamline operations as your practice scales

Frequently Asked Questions

Can I migrate from Nitrogen to Investipal?

Yes. Many advisors transition from Nitrogen to Investipal when they realize they need more than risk assessment and proposals. Investipal's statement scanning capabilities make it easy to onboard existing client portfolios, and the platform supports risk-based portfolio construction similar to Nitrogen's approach. Migration typically involves exporting client data from Nitrogen and uploading statements to Investipal for automated portfolio ingestion.

Does Investipal integrate with my CRM or custodian?

Investipal offers integrations with major advisor CRMs and custodians. Because Investipal includes statement scanning, it can work with accounts at any custodian - even those without direct integrations. Contact the Investipal team to discuss specific integration requirements for your firm.

How accurate is Investipal's statement scanning compared to manual entry?

Investipal's AI-powered OCR is trained on 50+ brokerage statement formats and achieves high accuracy for standard holdings. Complex securities or low-quality scans may require advisor review, but the platform flags any uncertain data for verification. In typical workflows, statement scanning reduces data entry time from hours to minutes while minimizing manual re-keying errors.

Can I use Investipal for risk assessment only, like Nitrogen?

Investipal's risk assessment is integrated into the broader workflow, but you can use it independently if needed. However, the platform's value is maximized when you leverage the complete intake-to-proposal-to-compliance pipeline. If you only need risk scoring and proposals, Nitrogen may be a more focused solution.

Does Investipal replace my portfolio management software?

For many advisors, yes. Investipal includes portfolio construction, optimization, drift monitoring, and rebalancing workflows. If you currently use separate portfolio management software alongside Nitrogen, Investipal can consolidate both into one platform. However, advisors with highly customized PM systems or specific reporting requirements should evaluate whether Investipal meets their needs during a demo.

What about compliance - is Investipal SEC-registered or FINRA-approved?

Investipal is a technology platform that assists advisors with documentation workflows. It is not investment advice, and all outputs require advisor review and approval. Investipal's IPS and Reg BI features help advisors generate compliant documentation, but they do not constitute legal advice. Advisors remain responsible for compliance with SEC regulations and applicable state requirements.

How long does it take to generate a proposal + IPS in Investipal?

In typical workflows where statements are clear and data quality is high, advisors can generate a proposal with accompanying IPS and Reg BI documentation in under 10 minutes. This assumes the advisor has uploaded statements, completed risk assessment, and built the proposed portfolio. Complex households or low-quality scans may require additional review time.

Can I try Investipal before committing?

Yes. Investipal offers demos and trial periods for qualified advisory firms. Book a demo to see the platform in action and test the workflow with your own client scenarios.

The Bottom Line: Point Solution vs. Unified Workflow

Nitrogen (Riskalyze) is a proven, best-in-class solution for risk assessment, risk-aligned proposals, and client engagement. If your practice is built around the Risk Number methodology and you have strong supporting tools for statement aggregation, compliance, and portfolio management, Nitrogen remains a solid choice.

Investipal offers a fundamentally different approach: a unified workflow platform that automates the entire journey from statement upload to proposal generation to IPS/Reg BI compliance to ongoing portfolio management. For advisors frustrated by fragmented tech stacks, manual data entry, and compliance workflows bolted onto separate tools, Investipal reduces tool sprawl and operational drag.

The choice comes down to your firm's priorities. If you want a focused risk communication tool and are comfortable managing multiple systems, Nitrogen fits that need. If you want to consolidate your tech stack, automate compliance documentation, and eliminate manual data entry, Investipal offers a more complete solution.

Ready to see how Investipal's end-to-end workflow compares? Book a 15-minute demo and upload a sample statement to see the platform in action.