As a growing financial advisor, you know proposals are crucial to converting prospects into clients. However, manually creating these documents with Excel, PDFs, and Word can become a significant bottleneck. Investment proposal software streamlines this critical step, helping advisors win more business with less effort.

Why Investment Proposal Software Matters

Most advisors spend too little time selling.

Financial advisors typically dedicate only about 20% of their time to building their client base. Admin tasks, especially creating investment proposals manually, consume valuable hours that could be spent on client relationships and growth.

Your proposals can be your best sales tool.

A well-crafted proposal clearly demonstrates your value. It helps build trust quickly by addressing client goals with personalized recommendations. Manual or generic proposals lack this impact, risking client hesitation or losing prospects to competitors who present more professional, tailored options.

Essential Features of Modern Proposal Tools

To effectively scale your firm, look for investment proposal software with these key capabilities:

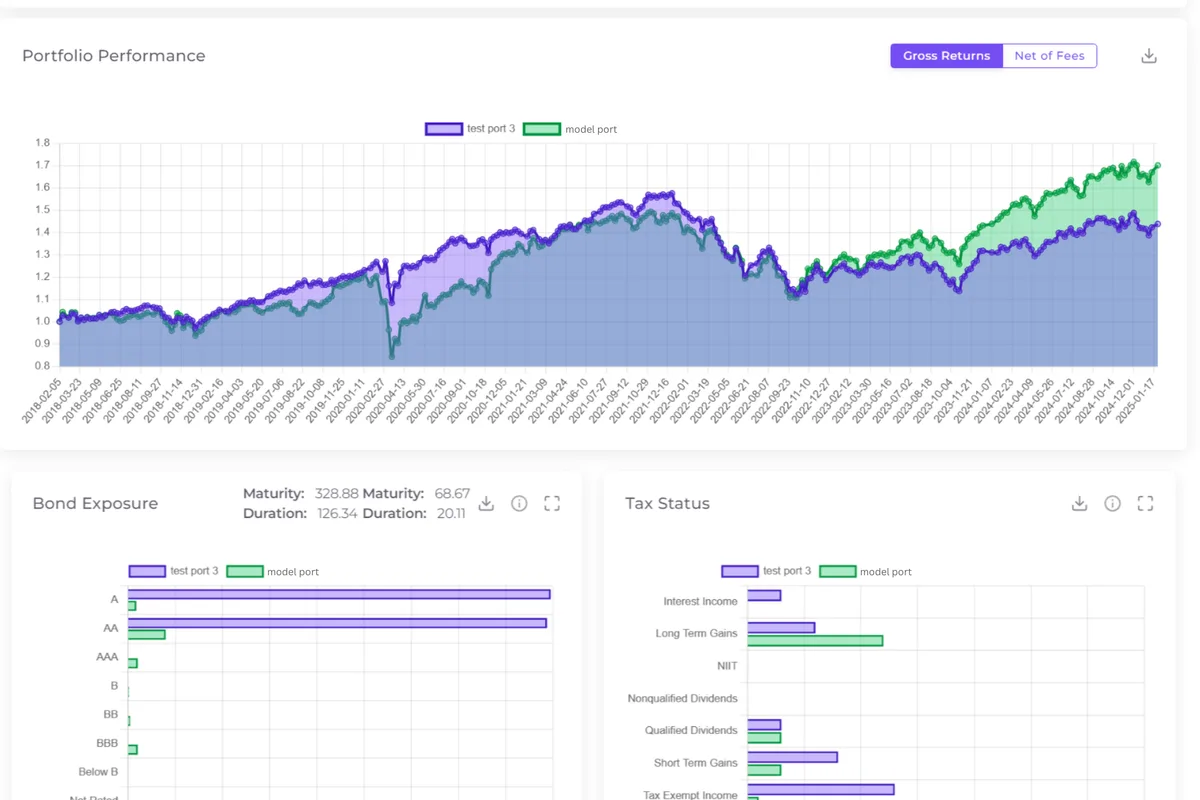

Portfolio Comparison

Your software should allow you to present side-by-side comparisons of your prospect's current portfolio and your proposed solution. Clear visuals help clients immediately understand the benefits.

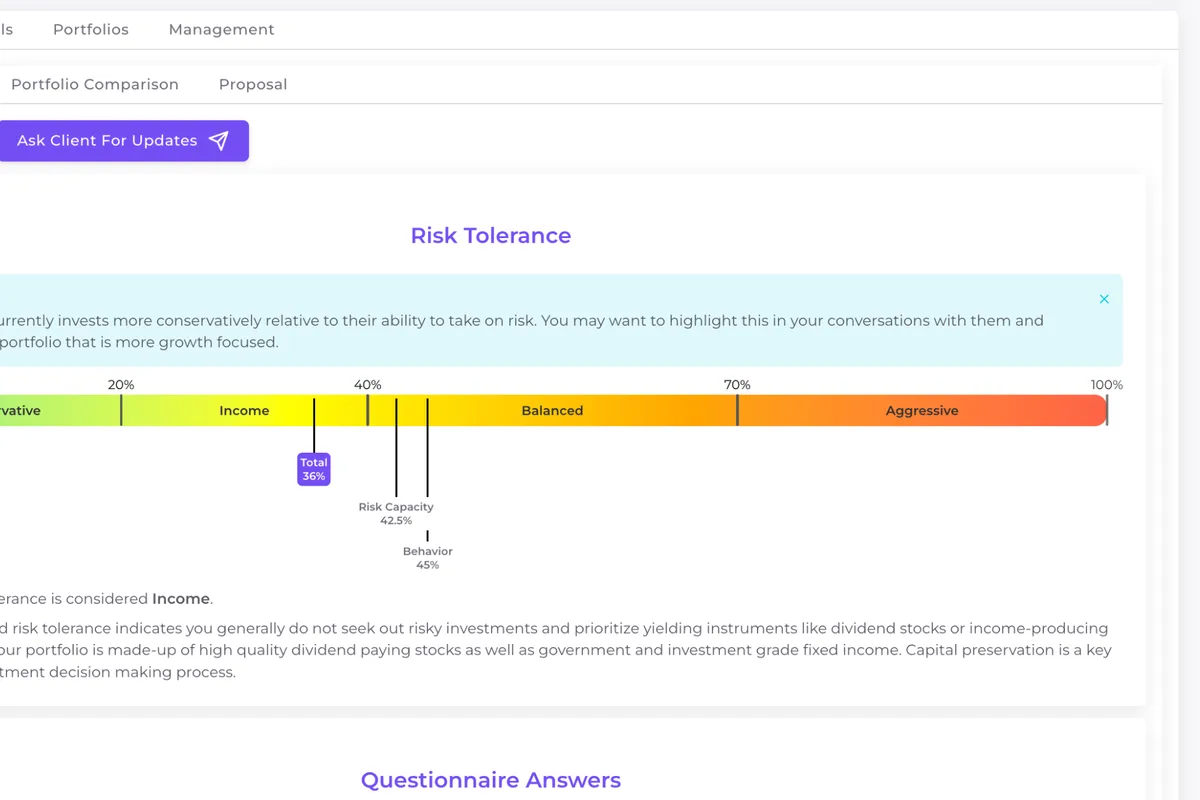

Risk Tolerance Alignment

Quickly assess and visually align your recommendations with the client's risk profile. Software that integrates easy-to-understand visuals helps reinforce client confidence.

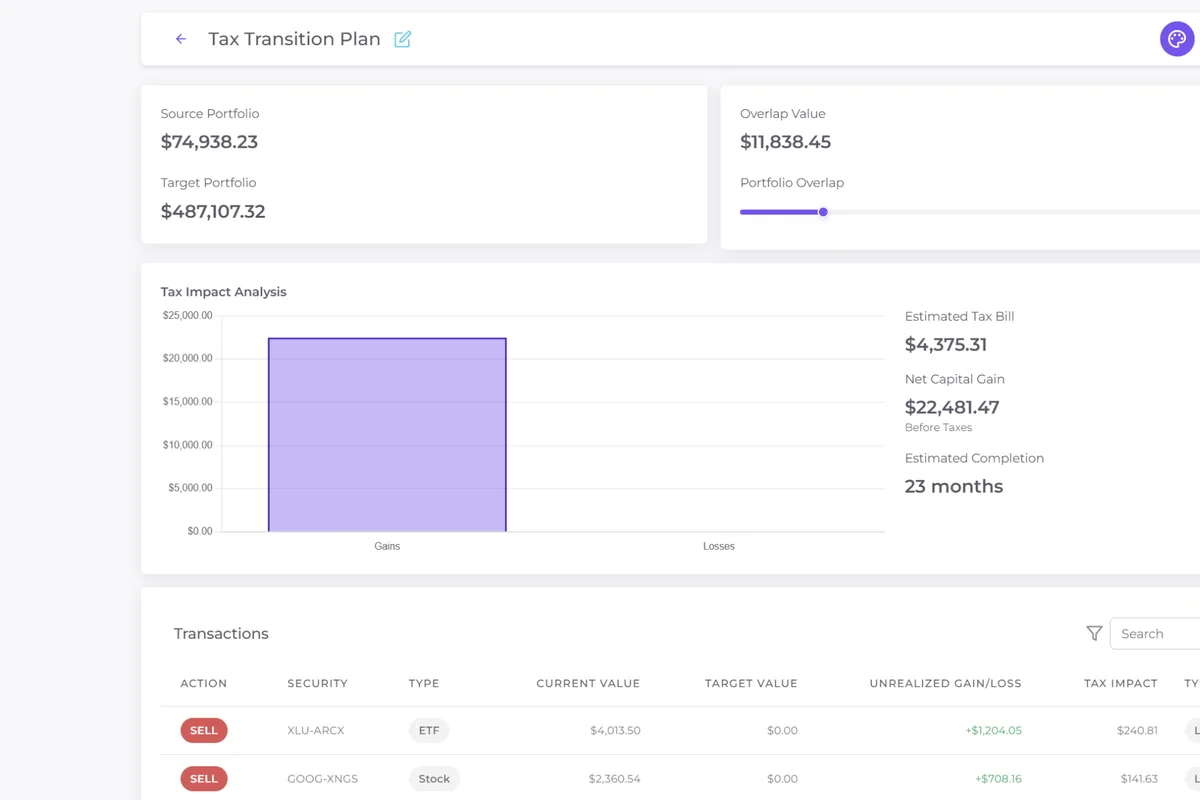

Tax Transition Modeling

Your proposals should illustrate the tax implications of switching portfolios, providing transparency and clarity. Highlighting both immediate impacts and long-term benefits can significantly improve client decisions.

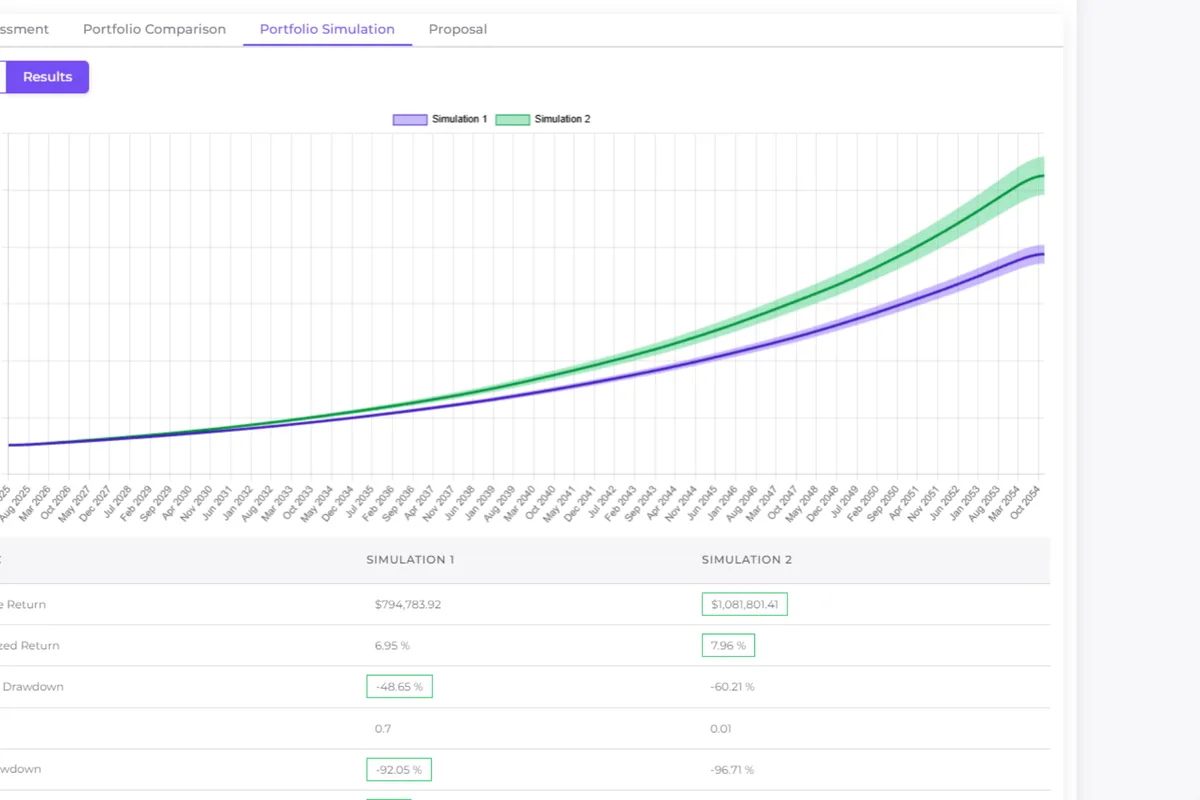

Monte Carlo Simulations

Including scenario planning with Monte Carlo simulations demonstrates the probability of achieving financial goals, adding depth and trustworthiness to your proposals.

Why Advisors Win More Clients with Software

Faster Proposals Mean Faster Decisions

Investment proposal software drastically reduces turnaround time. Advisors using these tools can generate customized proposals within minutes, making quick follow-ups possible and dramatically improving conversion rates.

Less Admin, More Time for Clients

Automating proposal creation frees up advisors to focus on building relationships, answering questions, and effectively addressing client needs. This focus on client relationships significantly enhances your value proposition.

Visuals Drive Client Understanding and Confidence

Clear visuals simplify complex financial information, helping prospects grasp the strategy quickly. This clarity often turns hesitant prospects into enthusiastic clients.

The Hidden Cost of Using Point Solutions

Firms often rely on multiple software tools. This approach creates inefficiencies, increases errors, and disrupts your sales momentum. Every extra minute spent juggling tools is time away from prospecting and client meetings.

How Investipal Simplifies Proposal Generation

Investipal offers an integrated proposal process designed specifically for advisors seeking growth:

- Automates the entire workflow—from initial prospect analysis to completed proposals.

- Utilizes powerful AI with data to create personalized, explainable recommendations.

- Supports comprehensive planning, covering both investment and insurance products within a single platform.

Advisors using Investipal report significantly reduced proposal times and improved close rates, enabling rapid scaling without additional staff.

Take Your Advisory Firm to the Next Level

If you're still manually crafting investment proposals, you're leaving opportunities—and revenue—on the table. Streamline your proposal process and improve your client experience.

Ready to see how much easier proposals can be?

.png?v=1)

.png)

%20(1).png)