Manage Complex Private Market Portfolios Without an Army of Analysts

Already won the client? Now manage their alternatives portfolio with precision. Stop reconciling capital calls across 20 Excel files. Track private equity, private credit, real assets, venture, and hedge strategies in one platform. Model capital calls, cash flows, waterfall structures, and performance metrics—from deal-level detail to total portfolio view.

Schedule a Demo

Trusted by advisory firms across North America

Never Miss a Capital Call Again

Stop guessing when to reserve cash for capital calls. Model drawdowns, distributions, waterfall structures, and return sequencing with precision. Track commitment pacing and cash flow obligations across 100+ private investments. Get alerts before capital calls are due so you always have liquidity ready.

Custom Private Security Builder

Create custom securities for private equity funds, private credit, co-investments, evergreen structures, and fund-of-funds. Define return profiles, liquidity terms, fee structures, and correlation assumptions. Model any private investment structure—no matter how complex.

Advanced Scenario Analysis & Stress Testing

Run stress tests for vintage risk, J-curve effects, correlation breakdowns, and liquidity crunches. See how private allocations perform when correlations break down or liquidity dries up. Compare alternative strategies vs. public market benchmarks to justify allocations.

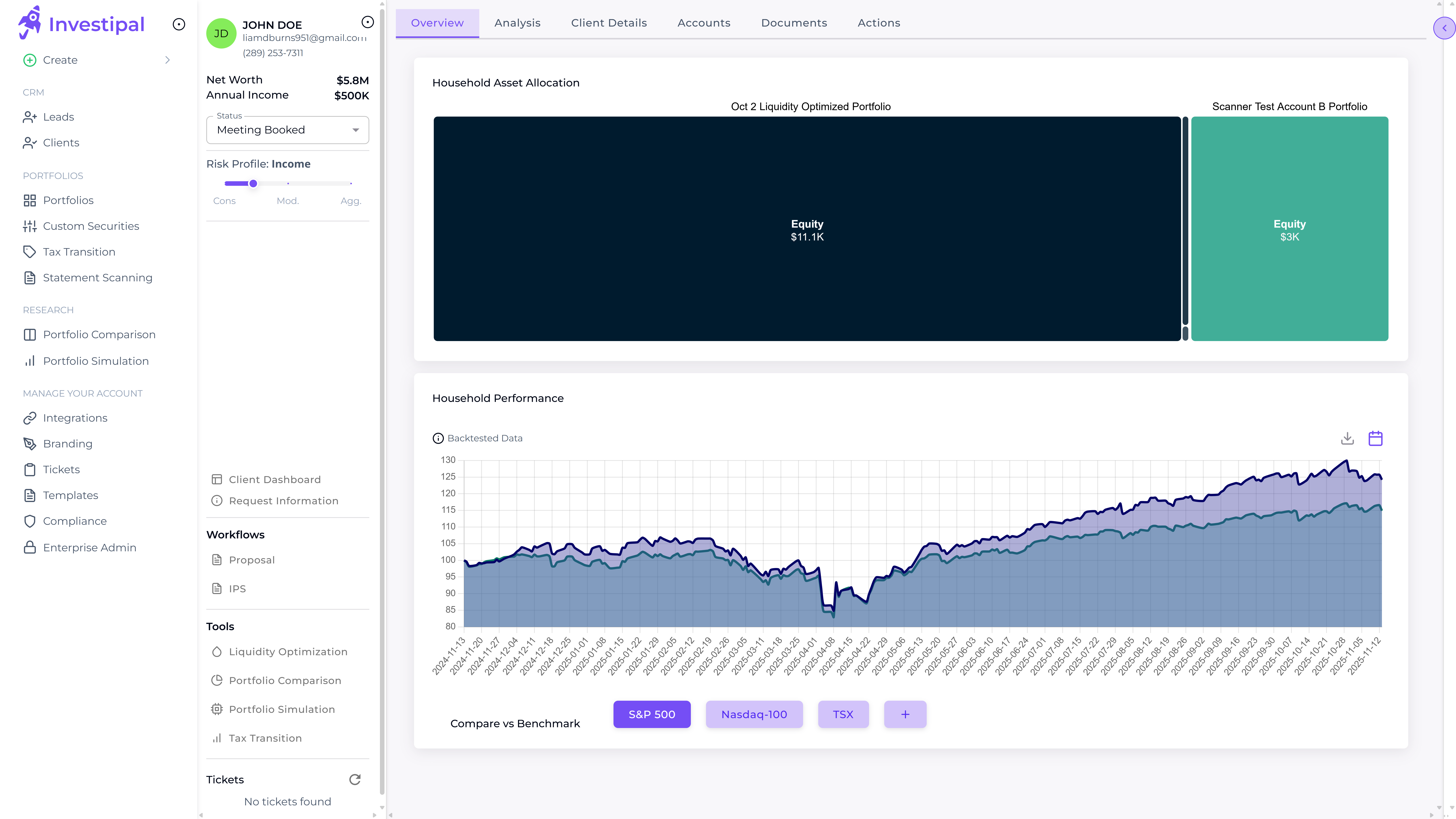

Unified Performance Reporting

Calculate true portfolio performance including both public and private assets in one view. Track IRR, TVPI, DPI, RVPI, and time-weighted returns across the entire portfolio with accurate cash flow accounting and quarterly valuation updates. No more separate reporting systems.

Perfect for: Multi-Family Offices Managing $500M+, RIAs with 20%+ Alternatives, Endowments & Foundations

Deliver institutional-grade alternatives management without hiring a team of analysts. Track 100+ private investments simultaneously.

Perfect for Your Practice

Discover how different financial professionals use this feature

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo