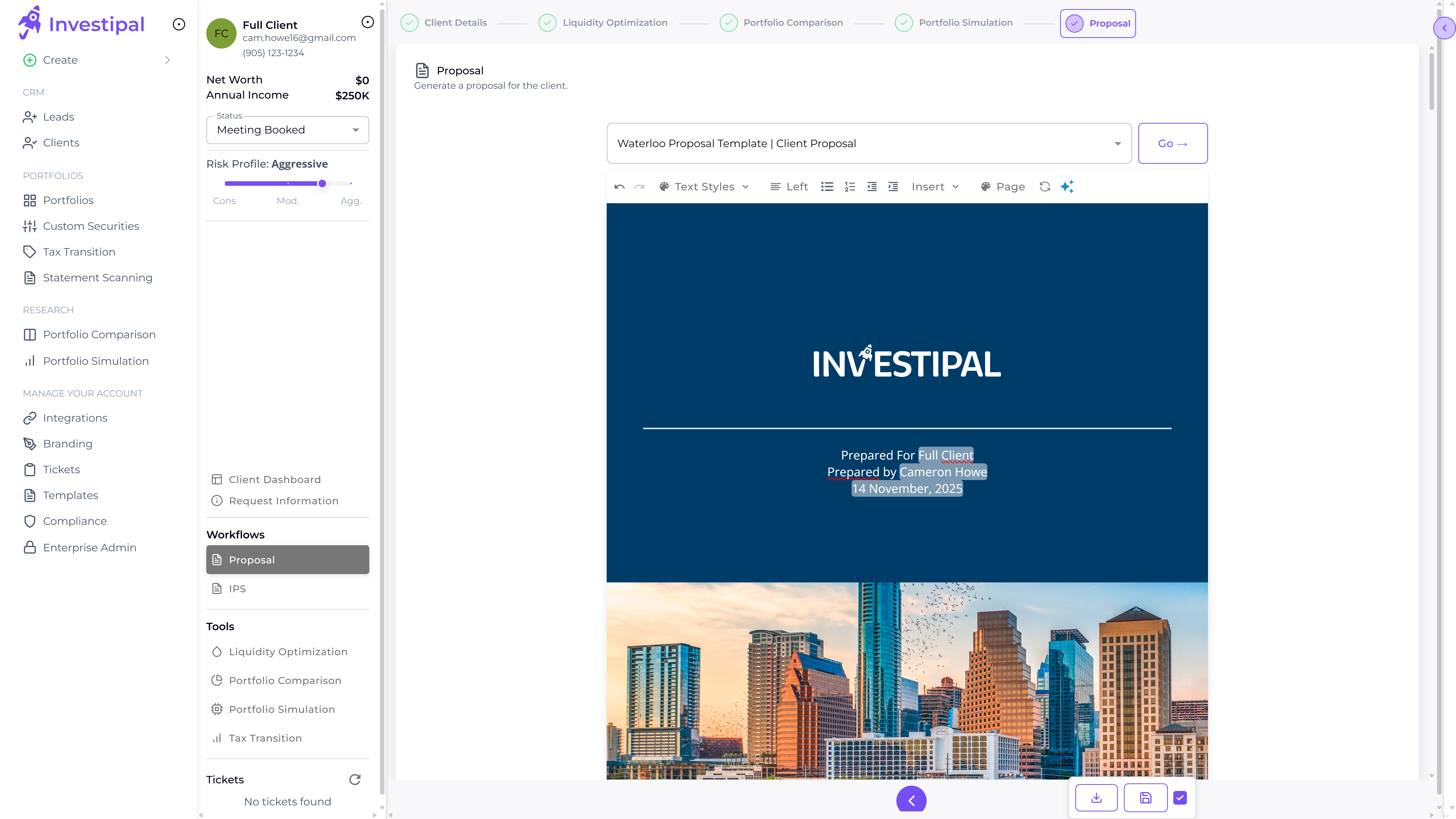

Win High-Net-Worth Clients with Institutional-Grade Alternative Investment Proposals

Stop losing prospects to competitors with better alternatives capabilities. Seamlessly integrate private equity, private credit, real estate, hedge funds, and custom private vehicles into client-ready proposals. Automatically incorporate risk scoring, liquidity constraints, fee modeling, and Reg BI compliance—all in 5 minutes.

Schedule a Demo

Trusted by advisory firms across North America

Seamless Alternatives Integration

Unlike traditional proposal tools that only handle public markets, add private equity, private credit, real estate, hedge funds, interval funds, and custom private vehicles directly into proposals alongside stocks and bonds. No manual workarounds, no separate systems—just one unified proposal.

Automatic Risk & Liquidity Scoring

Our engine automatically calculates risk metrics, liquidity constraints, and suitability scores for mixed public/private allocations. Ensure every proposal reflects accurate portfolio characteristics and regulatory requirements—no spreadsheet calculations needed.

Comprehensive Fee & Performance Modeling

Model management fees, performance fees, hurdle rates, and waterfall structures. Show prospects side-by-side comparisons with their current portfolios, including detailed fee impact analysis and net return projections. Make the case for alternatives crystal clear.

Compliance-Ready Documentation

Generate proposals that align with Reg BI and Know Your Product (KYP) requirements. Automated suitability checks, accreditation verification, and compliance audit trails built into every proposal. Pass compliance review the first time.

Close More HNW Clients by Offering What They Actually Want: Access to Alternatives

As HNW clients increasingly demand alternatives exposure, differentiate your practice with institutional-style proposals that showcase sophisticated portfolio construction.

Perfect for Your Practice

Discover how different financial professionals use this feature

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo