Unify Insurance and Investment Planning in One Platform

Model fixed indexed annuities with comprehensive parameter controls including participation rates, cap rates, floor rates, spreads, and crediting methods. Configure premium structures, accumulation periods, payout options, and COLA adjustments to show clients complete retirement income projections.

Schedule a Demo

Trusted by advisory firms across North America

Comprehensive Annuity Parameter Controls

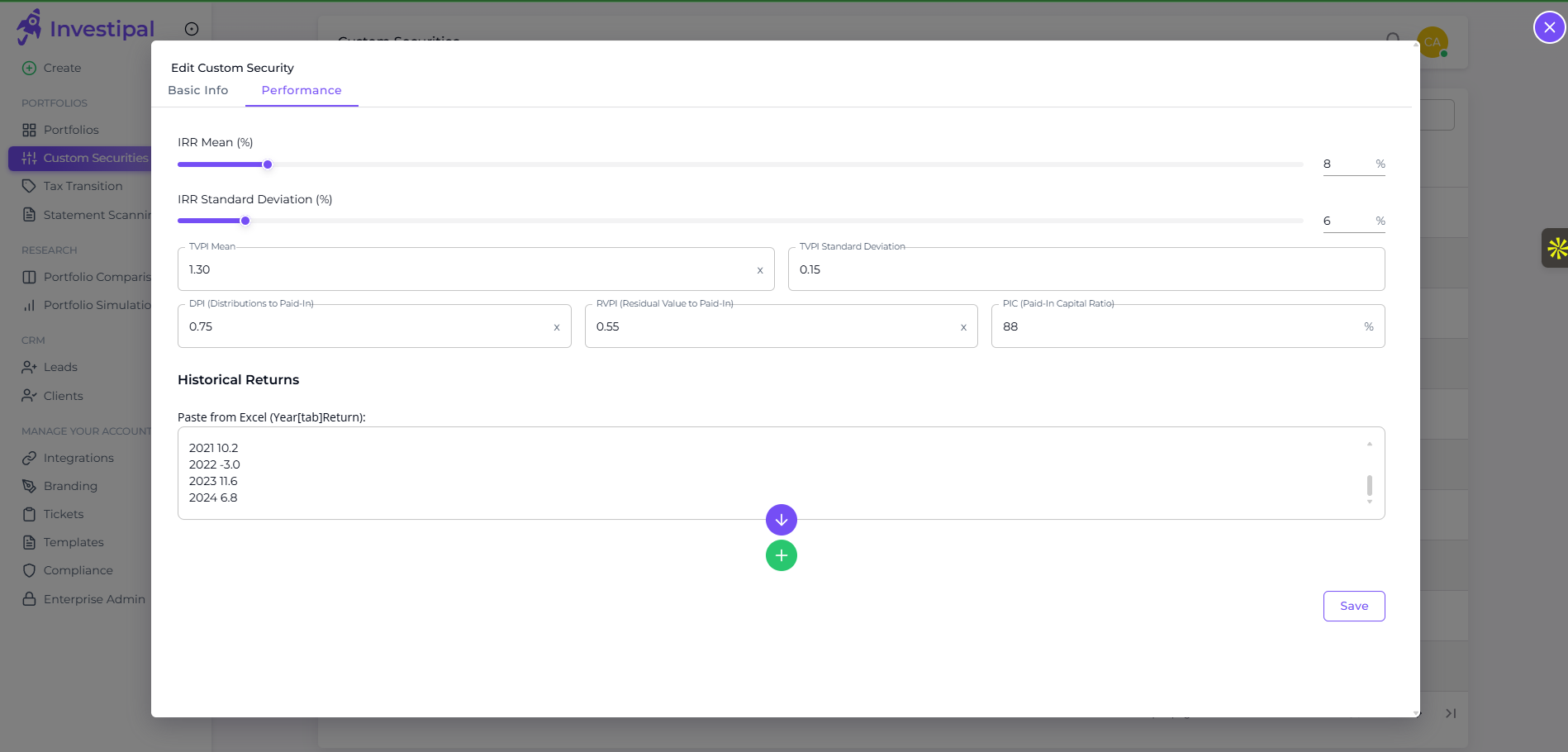

Configure participation rates, cap rates, floor rates, and spreads to model indexed annuity performance. Select crediting methods (Annual Point to Point, etc.) and set expected returns with volatility assumptions for accurate growth projections.

Flexible Premium & Payout Structures

Model various premium types, amounts, and frequencies. Define accumulation years and configure payout types, periods, and rates. Include COLA adjustments to show inflation-protected income streams that reflect real client scenarios.

Dynamic Contributions & Withdrawals

Add multiple contribution schedules and withdrawal events throughout the policy lifecycle. Model how additional premiums and systematic withdrawals impact cash value growth, income availability, and long-term policy performance.

Integrated Portfolio Simulations

Run side-by-side comparisons of annuity strategies versus portfolio-based approaches. Show clients how guaranteed income from annuities complements market-based investments, with clear visualizations of risk-adjusted returns and income certainty.

Insurance + Investments, Unified

Stop juggling separate systems for insurance and investment planning.

Perfect for Your Practice

Discover how different financial professionals use this feature

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo