Ensure Clients Never Run Out of Money: Match Every Dollar to a Future Goal

Stop using generic asset allocation models. Build portfolios that match real spending needs across time horizons—from next year's expenses to multi-generational wealth transfer. Our AI engine automatically maps client goals to appropriate liquidity buckets, then optimizes remaining assets for growth while respecting risk tolerance and regulatory constraints.

Schedule a Demo

Trusted by advisory firms across North America

Map Every Goal to the Right Time Horizon

Enter client spending needs by year—retirement income, college tuition, home purchase, legacy gifts—or paste directly from Excel. Our engine automatically organizes goals into short-term (0-3 years), medium-term (3-10 years), and long-term (10+ years) buckets, ensuring the right assets fund each goal.

Smart Asset Matching by Liquidity Need

The system automatically matches investment strategies to time horizons: high-liquidity assets for near-term goals, balanced approaches for medium-term needs, and growth-focused strategies for long-term objectives. No more guessing which investments belong where.

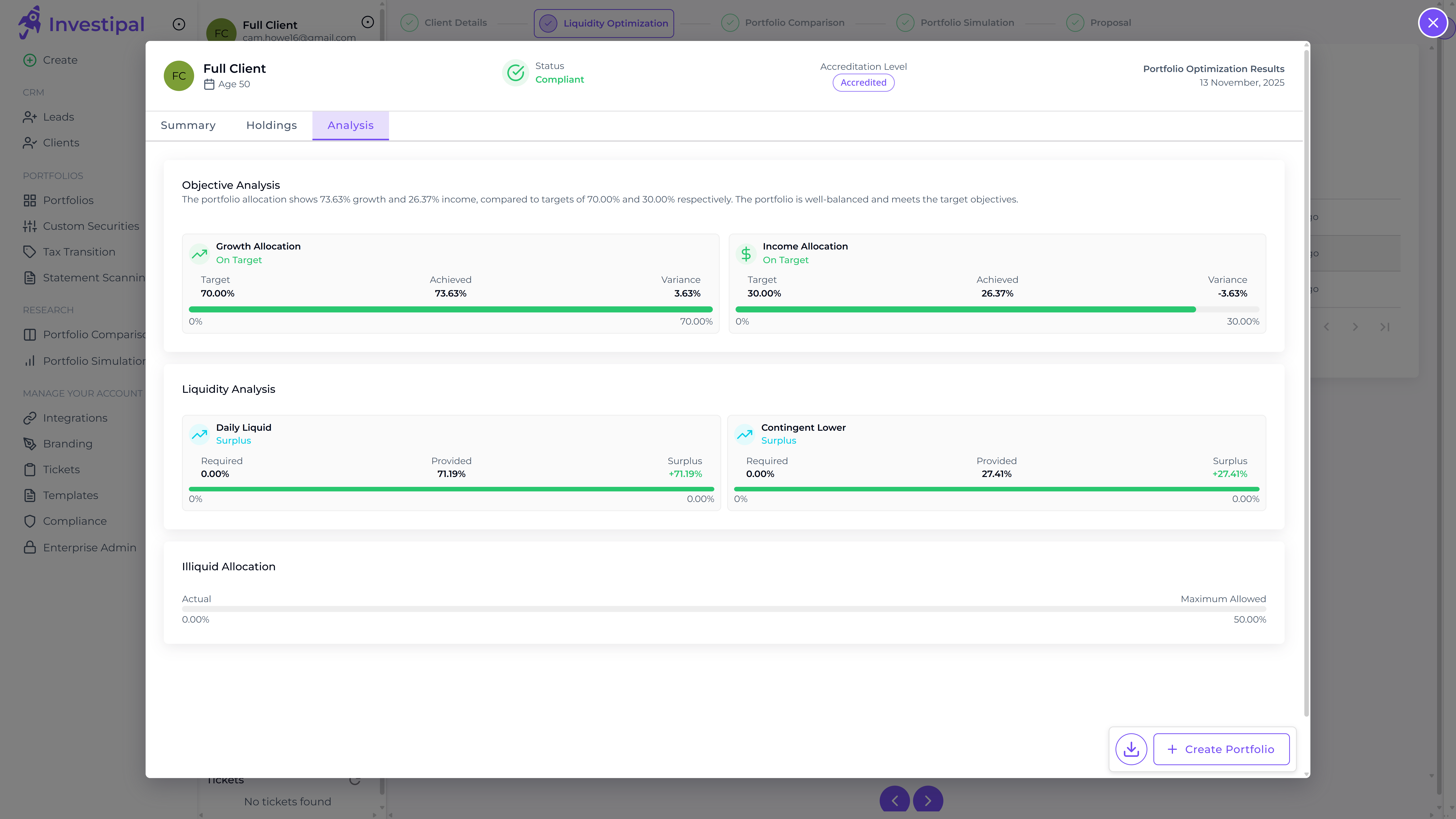

Automated Portfolio Optimization

Our AI engine builds the optimal portfolio by funding each goal first, then maximizing growth potential with remaining assets—all while staying within risk tolerance, meeting income targets, respecting regulatory limits, and maintaining proper diversification across your model universe.

Clear Goal-Funding Status & Alerts

See exactly which goals are fully funded, underfunded, or at risk. Get detailed diagnostics showing goal coverage by time period, portfolio risk vs. target, surplus/shortfall by bucket, and complete holdings breakdown. Receive alerts when goals drift off track.

Perfect for Retirement Planning, College Funding & Multi-Generational Wealth Transfer

Build portfolios that match real client goals—not generic risk scores. Show clients exactly how their money will fund their future.

Perfect for Your Practice

Discover how different financial professionals use this feature

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo