Close More Clients and Scale Your Practice. Without Hiring More Staff.

Automate your entire workflow—from prospect intake to portfolio construction to compliance documentation. Build portfolios across all asset classes including alternatives. Generate branded proposals in minutes. Most wealth managers save 15+ hours per week and close deals 3x faster.

Schedule a Demo

Trusted by advisory firms across North America

Scale Your Wealth Management Practice with AI

Manage more clients without sacrificing personalization. Build portfolios across all asset classes—equities, fixed income, alternatives, and annuities. Automate your sales workflow from prospect intake to signed proposals. Stay compliant with auto-generated IPS and Reg BI documentation.

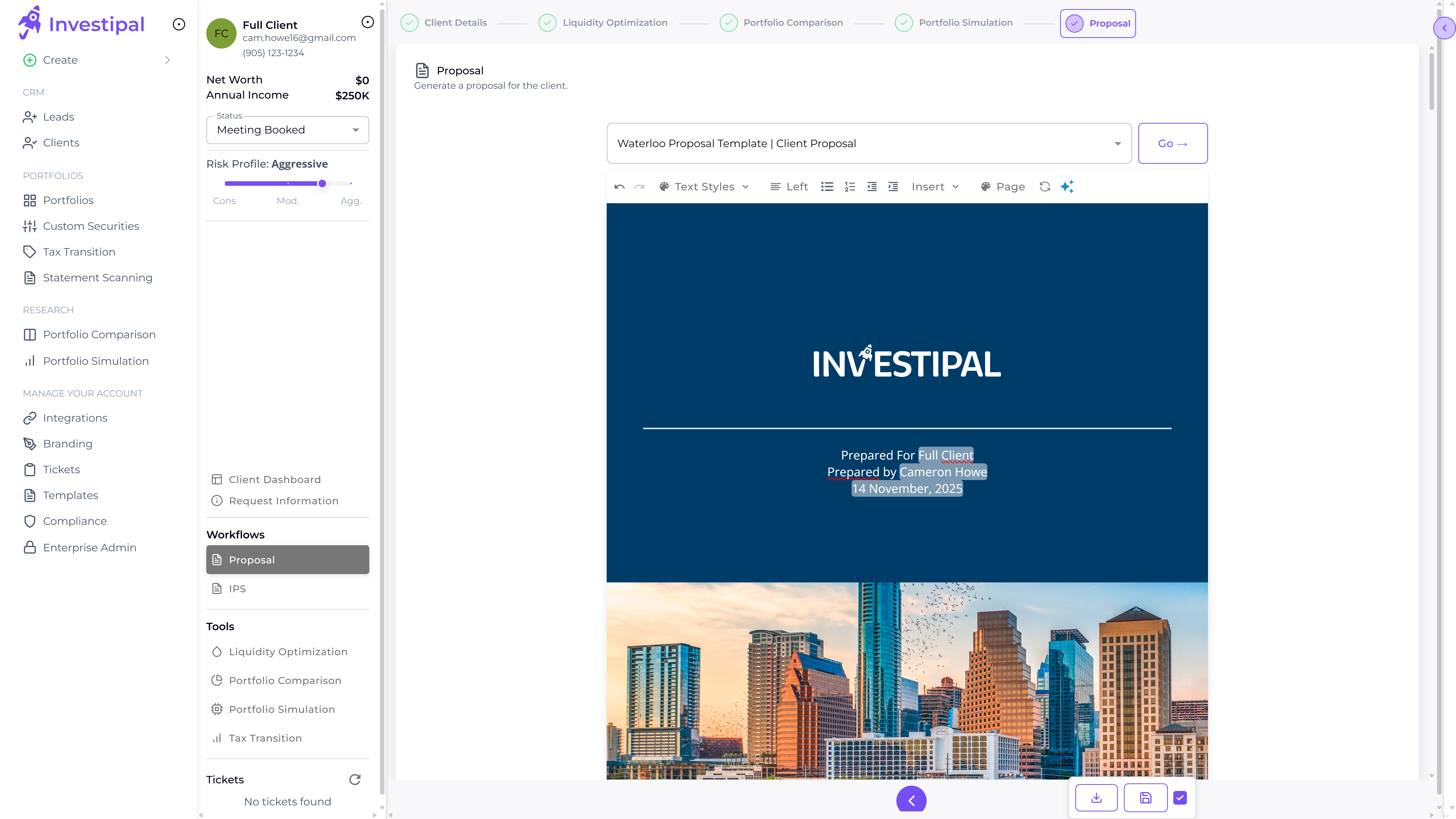

Close Prospects in 2-3 Days Instead of 2-4 Weeks

- Automated prospect intake – Send prospects a secure link for risk questionnaires and document upload. They complete it on their phone in 10 minutes. You get notified when done—no back-and-forth emails or manual data entry.

- Instant AI-powered portfolio analysis – Upload their current statements, and the AI extracts holdings and runs portfolio comparison, Monte Carlo simulation, and tax transition analysis automatically. Identify opportunities in seconds, not hours.

- One-click proposal generation – Turn your analysis into a branded, professional proposal with charts, projections, and recommendations in 2 minutes. Customize your template once, then auto-generate every proposal. Send for e-signature directly from the platform.

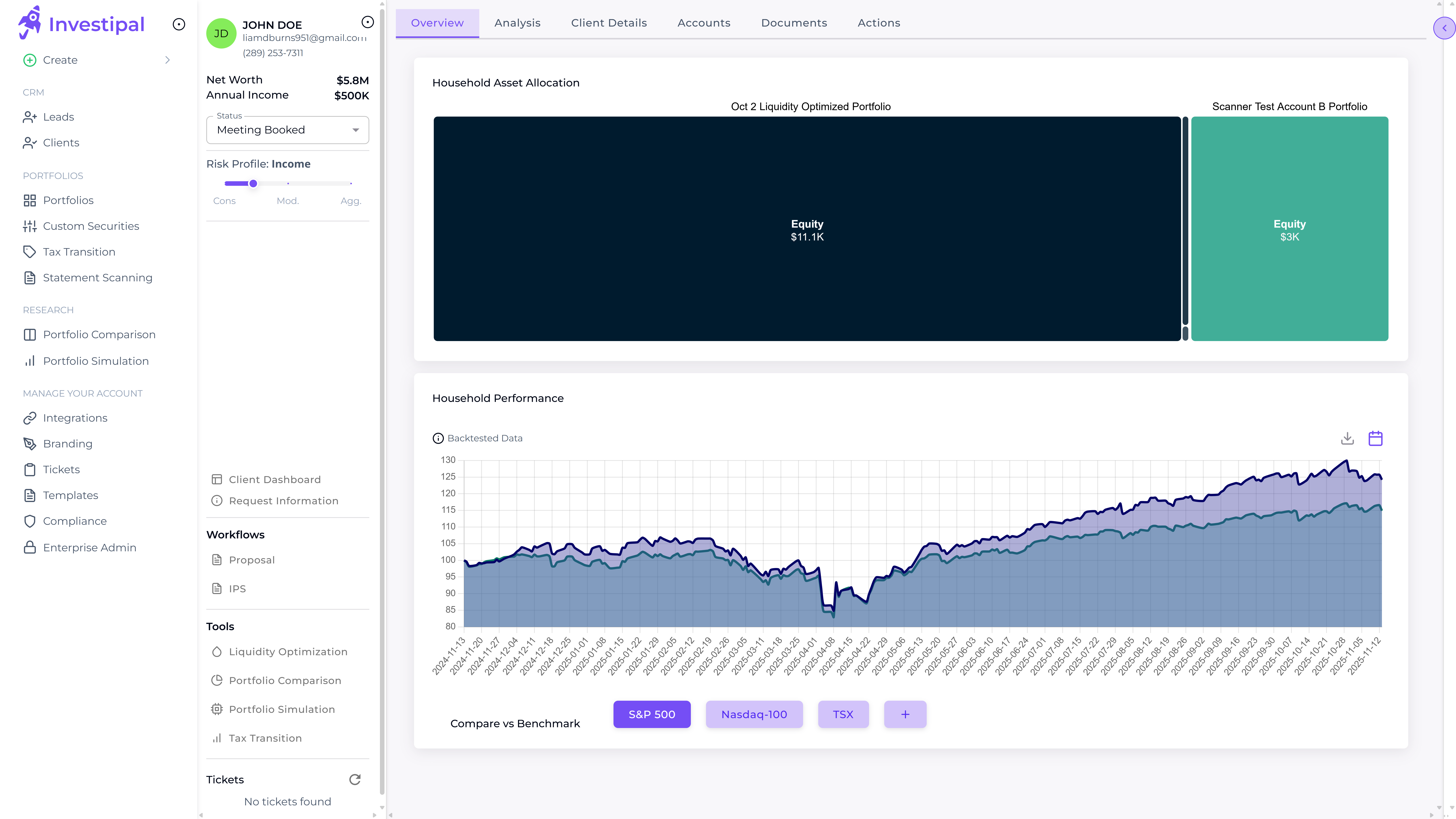

Build Personalized Portfolios Across All Asset Classes

- Multi-asset portfolio construction – Build portfolios with equities, fixed income, alternatives (PE, VC, real estate, private credit), and annuities. Access our database of private market securities with risk/return/performance metrics, or model custom alternatives if not in our database.

- AI-powered portfolio optimization – Whether it's retirement income, wealth transfer, or liquidity planning, the AI optimizes allocations across all asset classes based on client goals and time horizons. Run portfolio comparison, Monte Carlo simulation, and tax transition analysis in seconds.

- Goal-based and risk-based strategies – Match client spending needs to optimal allocations with goal-based construction. Or use traditional risk-based asset allocation. Choose the right approach for each client—all in one platform.

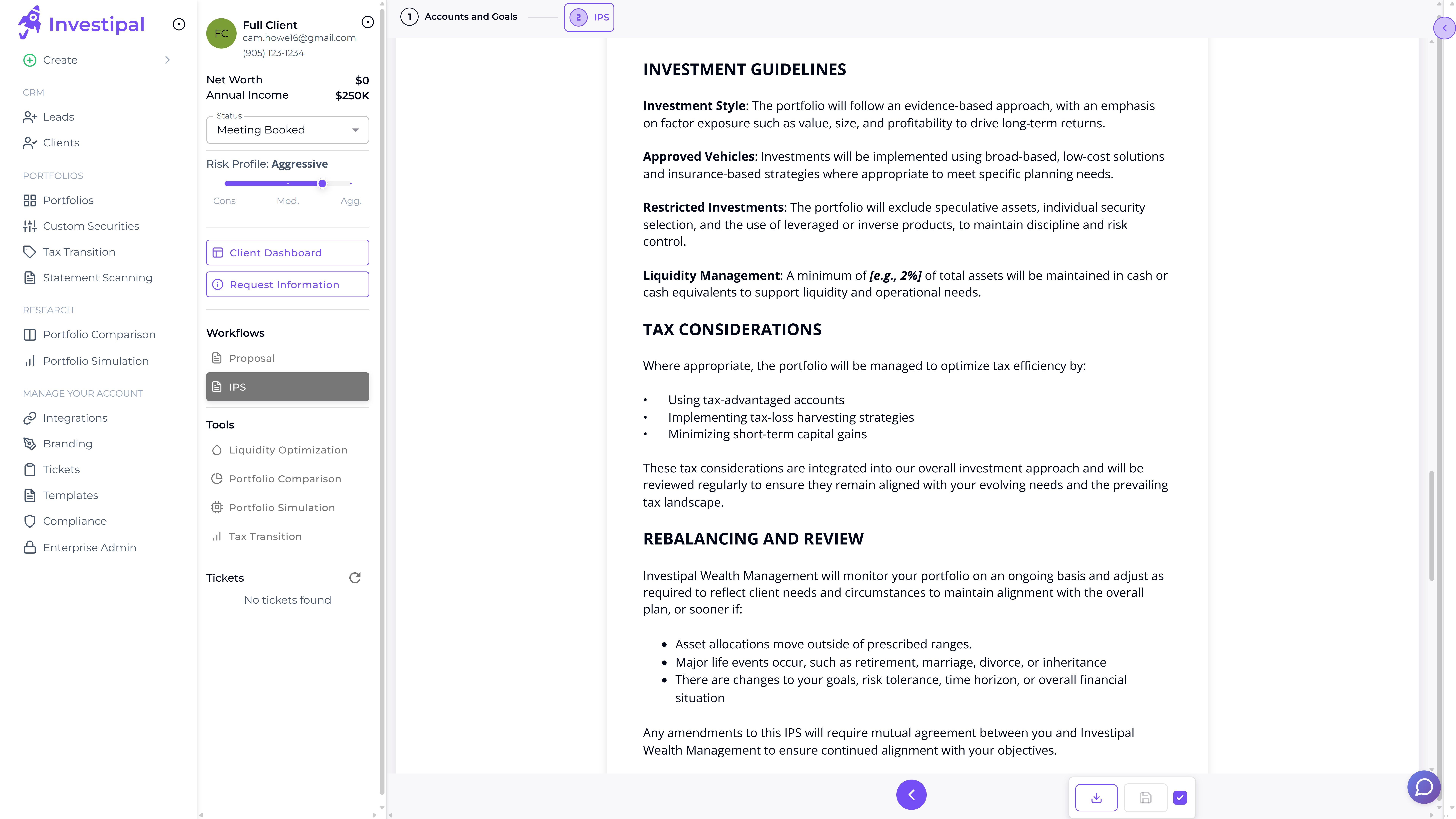

Stay Compliant Without Thinking About It

- Auto-generate compliance documents – Every portfolio analysis automatically generates compliant IPS and Reg BI documentation pre-filled with client data, portfolio details, and disclosures. Just review, customize if needed, and send for e-signature. No templates to fill out manually.

- 24/7 portfolio monitoring with alerts – Set drift thresholds once (e.g., 5% from target allocation), and Investipal monitors every portfolio 24/7. Get instant alerts when rebalancing is needed or when concentration risk exceeds limits—before clients notice or regulators ask.

- Complete audit trails and reporting – Every client action is logged with timestamps and documentation. Generate compliance reports for audits in one click. Show exactly when and why every portfolio decision was made—no scrambling to gather paperwork.

Spend more time advising and less time on admin

Free up your time to spend on higher-value activities.

Explore Our Key Features

Powerful tools designed specifically for wealth managers

Statement Scanner

Extract and analyze client portfolio data from any statement format instantly

Portfolio Optimization

AI-powered asset allocation across public and alternative investments

Client Acquisition

Automate proposals, risk assessment, and prospect conversion

Risk Management

Real-time risk monitoring and automated portfolio rebalancing

Reg BI Compliance

Automated compliance documentation and disclosure generation

IPS Generator

Generate personalized Investment Policy Statements with AI

Frequently Asked Questions

Have questions? We have answers.

Access our database of private equity, real estate, private credit, and venture capital with risk/return/performance metrics. Each security includes correlation data and historical returns. Don't see what you need? Build custom alternatives with our security builder—define return profiles, volatility, liquidity terms, fees, and correlations.

Yes. Build portfolios with equities, fixed income, alternatives, and annuities in one unified workflow. Run portfolio comparison, Monte Carlo simulation, and risk assessment across all asset classes. See how private allocations impact overall portfolio risk/return profiles.

Most wealth managers go from initial meeting to signed proposal in 2-3 days with Investipal—compared to 2-4 weeks traditionally. The AI automates data entry, portfolio analysis, and proposal generation, so you can move faster while maintaining quality.

Yes. Goal-based construction works for any client with specific, time-bound goals—whether that's retirement income, wealth transfer, liquidity planning, or charitable giving. The AI optimizes allocations across all asset classes (equities, fixed income, alternatives, annuities) based on the client's goals and time horizons.

Set drift thresholds once (e.g., 5% from target allocation), and Investipal monitors every portfolio 24/7. You get real-time alerts when rebalancing is needed, when concentration risk exceeds limits, or when compliance breaches occur. Every action is logged for audit trails.

Yes. Customize your proposal template once with your branding, disclosures, and formatting preferences. Then every proposal is auto-generated from your portfolio analysis using that template. You can have multiple templates for different client types or services.

Investipal integrates with major custodians (Schwab, Fidelity, TD Ameritrade, Pershing, etc.), CRMs (Salesforce, Redtail, Wealthbox, etc.), and portfolio accounting systems (Black Diamond, Orion, Tamarac, etc.). We also offer account aggregation for held-away assets.

Most wealth managers are fully onboarded in 1-2 weeks. This includes branding setup, client data import, compliance template configuration, and team training. We provide dedicated onboarding support and weekly check-ins to ensure success.

Pricing is based on AUM and number of advisors. Contact us for a custom quote. Most wealth managers save 15+ hours per week on portfolio construction and compliance alone, which typically pays for the software many times over.

Yes. Investipal is SOC 2 Type II certified with bank-level 256-bit AES encryption. All data is encrypted in transit and at rest. We never sell or share client data. Your data is yours, and you can export it anytime.

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo