Model FIAs and IULs with Precision. Then Integrate into Retirement Plans.

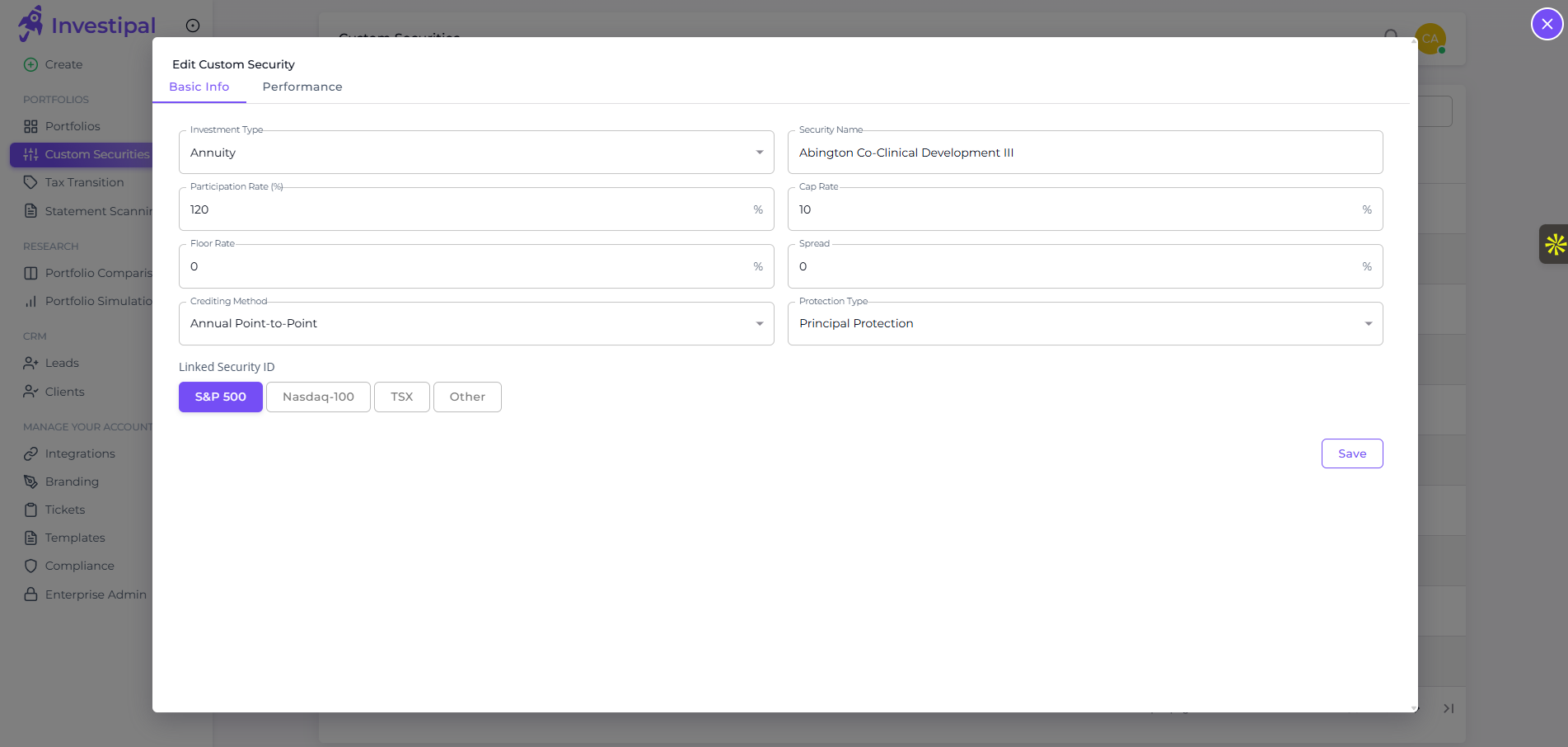

Configure participation rates, cap rates, floor rates, spreads, and crediting methods for fixed indexed annuities and IULs. Then run Monte Carlo projections to show complete retirement income—combining insurance with investment portfolios.

Schedule a Demo

Trusted by advisory firms across North America

Unify Insurance and Investment Planning

Model complex annuities and IUL products with precision, then integrate them seamlessly into comprehensive retirement income plans. Show clients the complete picture—not just the insurance piece.

Model Any Annuity or IUL Product in Minutes

- Configure every parameter – Set participation rates, cap rates, floor rates, spreads, and crediting methods for any FIA or IUL product. Model accumulation periods, withdrawal strategies, and COLA adjustments with precision.

- Compare products side-by-side – Model multiple annuity products with different parameters and see projections side-by-side. Show clients which product performs best under different market scenarios.

- Run Monte Carlo projections – Project retirement income with confidence bands and probability analysis. Show clients the range of possible outcomes—not just the best-case scenario.

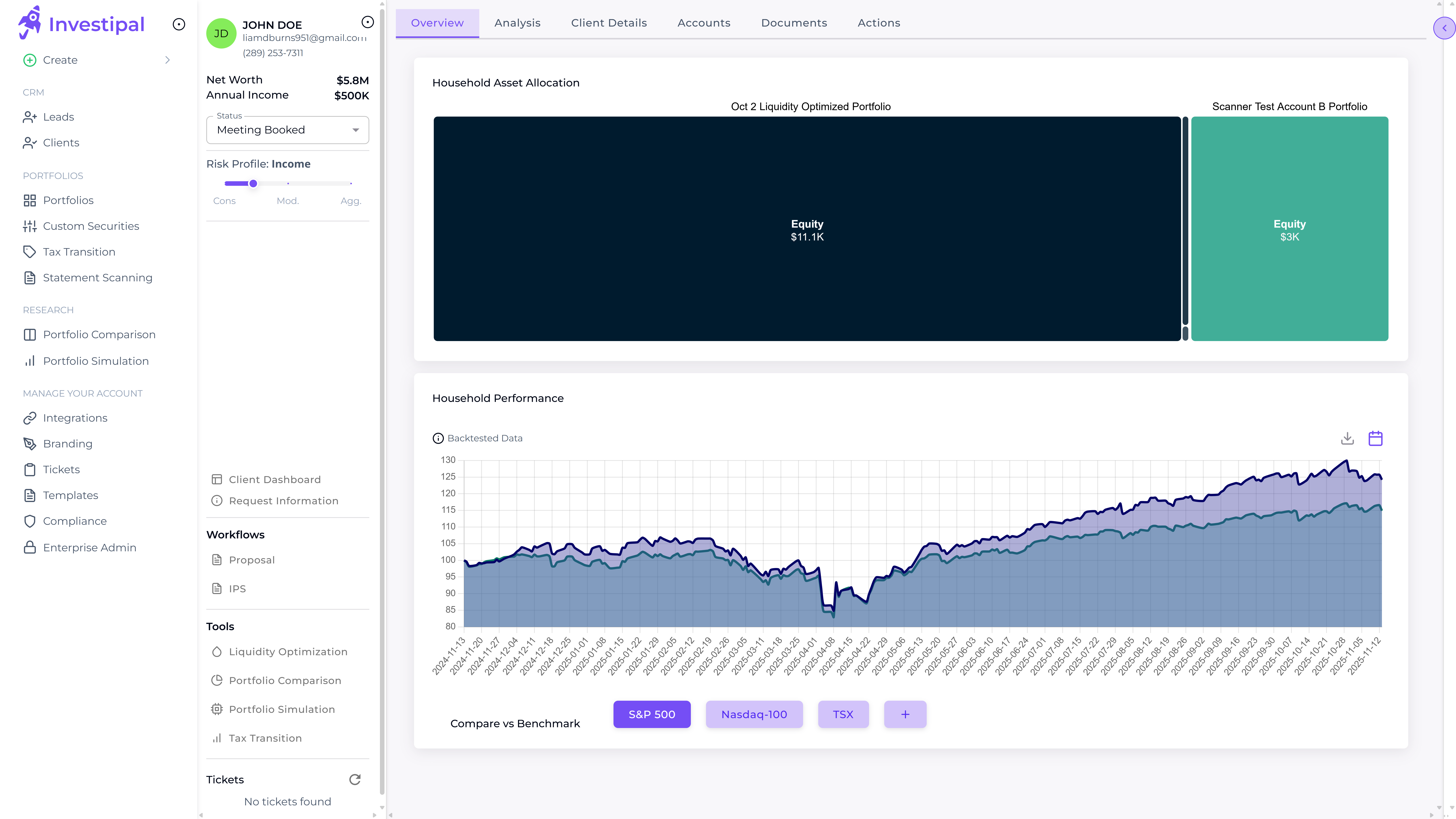

Show Clients the Complete Retirement Picture

- Combine insurance + investments – Model annuities and IULs alongside investment portfolios. Show clients how insurance products fit into their complete retirement income strategy—not just as standalone products.

- Compare funding strategies – Run scenarios with different premium amounts, withdrawal strategies, and COLA adjustments. Show clients which strategy maximizes retirement income with the least risk.

- Visualize probability of success – Monte Carlo projections show confidence bands and probability analysis. Clients see the range of possible outcomes—not just the rosy best-case scenario.

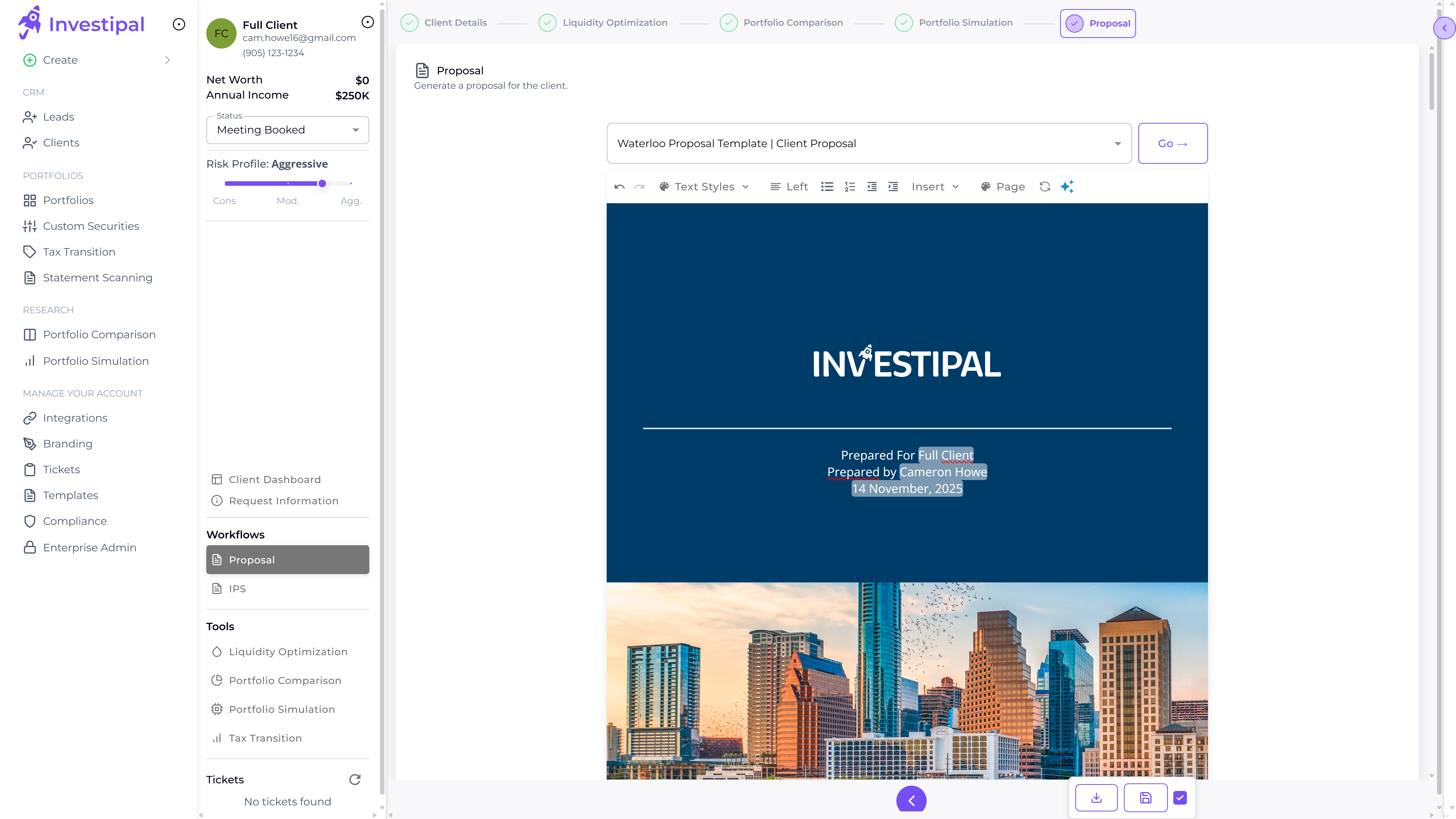

Generate Professional Proposals in 2 Minutes

- One-click proposal generation – Your annuity analysis automatically becomes a professional proposal with charts, projections, and recommendations. Customize the template once, then auto-generate for every client.

- Client-friendly visuals – Complex insurance products are explained with clear charts, side-by-side comparisons, and probability visualizations. Clients understand what they're buying—not just signing.

- Built-in compliance disclosures – Every proposal includes required regulatory disclosures automatically. No risk of missing disclosures or compliance issues. Send for e-signature directly from Investipal.

Spend more time advising and less time on admin

Free up your time to spend on higher-value activities.

Explore Our Key Features

Powerful tools designed specifically for insurance

Statement Scanner

Extract and analyze client portfolio data from any statement format instantly

Portfolio Optimization

AI-powered asset allocation across public and alternative investments

Client Acquisition

Automate proposals, risk assessment, and prospect conversion

Risk Management

Real-time risk monitoring and automated portfolio rebalancing

Reg BI Compliance

Automated compliance documentation and disclosure generation

IPS Generator

Generate personalized Investment Policy Statements with AI

Frequently Asked Questions

Have questions? We have answers.

You can model any fixed indexed annuity (FIA) or indexed universal life (IUL) product. Configure participation rates, cap rates, floor rates, spreads, and crediting methods for any carrier's product. Model accumulation periods, withdrawal strategies, COLA adjustments, and premium structures with full control.

Model multiple annuity products with different parameters and see projections side-by-side. Run Monte Carlo simulations for each product to show clients which performs best under different market scenarios. Compare guaranteed income, upside potential, and downside protection across products.

Yes. Model annuities and IULs alongside investment portfolios to show clients complete retirement income projections. See how insurance products fit into the overall retirement strategy—not just as standalone products. Run unified Monte Carlo projections showing total retirement income from all sources.

Most advisors go from modeling to signed proposal in under 10 minutes. Configure the annuity parameters, run projections, and Investipal auto-generates a professional proposal with charts, comparisons, and disclosures. Customize the template once, then auto-generate for every client.

Yes. Every proposal includes required regulatory disclosures automatically—no risk of missing disclosures or compliance issues. Customize disclosures once in your template, and they're included in every proposal. Send for e-signature directly from Investipal.

Yes. Run Monte Carlo projections showing retirement income with confidence bands and probability analysis. Show clients the range of possible outcomes—not just the best-case scenario. Compare probability of success across different products and funding strategies.

Configure COLA (Cost of Living Adjustment) rates for withdrawal strategies. Model how inflation-adjusted withdrawals impact account values over time. Show clients how COLA affects their purchasing power in retirement.

Investipal integrates with major custodians and CRMs. We also offer account aggregation for held-away assets, so you can see the complete financial picture—insurance, investments, and other assets—in one place.

Most insurance advisors are fully onboarded in 1 week. This includes setting up your branding, configuring annuity product templates, and training on the modeling tools. We provide dedicated onboarding support to ensure you're productive quickly.

Pricing is based on the number of advisors and volume of proposals. Contact us for a custom quote. Most insurance advisors save 10+ hours per week on modeling and proposal creation, which typically pays for the software many times over.

Enterprise-Grade Security

Your data is protected with bank-level security

Compliance & Privacy

Ensure adherence to SEC/FINRA standards with built-in compliance and privacy features. No user data is used in training.

Security

Investipal is SOC2 Type II compliant and all data is fully protected with advanced encryption and secure protocols.

Scalability

Grow through technology, not headcount.

"We're deeply committed to integrating cutting-edge technology to transform the financial planning and investment management landscape. Investipal's innovative approach aligns perfectly with our vision, particularly in utilizing OCR technology to streamline processes to elevate the client and advisor experience."

See Investipal in Action

Curious how Investipal can help accelerate your firm's growth? Chat with one of our solution experts.

Schedule a Demo