Your client has a comprehensive financial plan showing they need $120,000 per year in retirement, $50,000 for a car in 5 years, and $100,000 for their grandchild's education in 10 years. You export the plan to PDF, then open your portfolio management system and... build a generic 60/40 portfolio based on their risk score.

Three months later, markets drop 20%. Your client calls, panicked: "I know the plan says I'll be fine, but should I sell? Will I actually have the money when I need it?"

Here's the problem: most advisors create financial plans in one system and build portfolios in another—leaving a dangerous gap between planning and implementation. The financial plan shows when money is needed, but the portfolio is built around risk tolerance, not spending needs.

Goal-based portfolio construction bridges this gap by automatically connecting your financial plan to investment allocations. Instead of building portfolios around abstract risk scores, you input client spending needs (from your financial plan) and AI automatically builds a portfolio that matches every dollar to when it's actually needed—whether that's next year's expenses or 30 years of retirement income planning.

In this guide, you'll learn how goal-based portfolio construction connects financial planning to portfolio implementation, why it works for both retirees and pre-retirees with specific goals, and how to implement it in your practice using modern wealth management software and financial advisor portfolio tools.

The Planning-to-Portfolio Gap: Why Traditional Allocation Fails

The 60/40 portfolio has been the default allocation for decades—whether you're planning for retirement, saving for a home, or funding education. But it was designed for a different era—one without specific financial planning goals, 30-year retirements, and extreme market volatility.

Why Generic Allocation Models Fail Goal-Driven Clients

Traditional asset allocation models have three critical flaws when applied to clients with specific financial goals:

- Disconnects Planning from Implementation: Your financial plan shows specific spending needs by year, but your portfolio is built around a generic risk score. The plan says "I need $50K in year 5," but the portfolio just says "60% stocks, 40% bonds."

- Ignores Time Horizons: A client needs cash next year for a home down payment and growth assets for retirement in 30 years. A single 60/40 allocation treats all money the same, regardless of when it's needed.

- Maximizes Sequence Risk: Selling growth assets during a downturn to fund planned expenses locks in losses. The order of returns matters more than average returns when you have time-bound goals.

- Creates Client Anxiety: When markets drop 20%, clients panic because they don't know which dollars are "safe" for near-term goals and which can stay invested long-term.

Real-World Example: Financial Plan vs. Portfolio Reality

The Financial Plan Says:

- Year 1-5: $120,000/year living expenses

- Year 3: $75,000 home renovation

- Year 5: $50,000 new car

- Year 10: $100,000 grandchild education

- Year 6-30: $125,000/year retirement income

The Traditional Portfolio Says:

- 60% stocks, 40% bonds

- Risk score: 60

- Expected return: 7% annually

The Problem: When markets crash in Year 2, the client asks "Can I still afford the renovation in Year 3?" The portfolio can't answer that question—it only knows risk tolerance, not spending needs.

The Goal-Based Solution: The portfolio is built directly from the financial plan. The system shows: "Years 1-5 fully funded with liquid assets. Home renovation and car purchase secured. Long-term retirement assets can stay invested—you won't need them for 6+ years."

Example: Goal-based portfolio construction dashboard showing clear overview of total assets, liquidity position, risk score, and goal-funding status.

What is Goal-Based Portfolio Construction?

Goal-based portfolio construction (also called liability-driven investing or spending-based asset allocation) is an investment strategy that uses AI to automatically match assets to specific future spending needs based on time horizons and liquidity requirements.

The Key Innovation: It connects your financial planning output directly to portfolio implementation. Instead of creating a plan in one system and then manually translating it into a portfolio in another, goal-based construction takes the spending sequence from your financial plan and automatically builds the optimal portfolio to fund those goals.

Bridging the Planning-to-Portfolio Gap

Traditional workflow:

- Create financial plan → Shows spending needs by year

- Export to PDF → Plan sits in document library

- Open portfolio system → Build allocation based on risk score

- Hope the portfolio funds the plan → No direct connection

Goal-based workflow:

- Input spending needs from financial plan → Year-by-year sequence

- AI calculates optimal allocation → Matches spending to liquidity/growth

- Review goal-funding status → See which goals are secured

- Portfolio directly implements the plan → Complete integration

Core Principles

Instead of asking "What's your risk tolerance?" goal-based construction asks:

- When do you need this money? (Time horizon)

- How much do you need? (Spending requirements)

- What's the purpose? (Essential expenses vs. discretionary goals)

- What's the priority? (Must-have vs. nice-to-have)

Modern goal-based portfolio software then uses AI to automatically:

- Calculate liquidity requirements based on your spending sequence

- Determine optimal liquid/growth allocation that funds all goals while maximizing returns

- Build custom portfolios using your model portfolios and investment universe

- Ensure compliance with risk tolerance, accreditation levels, and regulatory constraints

How It Differs from Traditional Allocation

| Traditional Allocation | Goal-Based Construction |

|---|---|

| Starts with risk tolerance | Starts with spending needs |

| One allocation for entire portfolio | AI-optimized liquid/growth split based on goals |

| Rebalances to fixed percentages | Monitors goal-funding status continuously |

| Focuses on maximizing returns | Focuses on funding goals with certainty |

| Client sees total portfolio value | Client sees which goals are funded vs. at risk |

| Manual portfolio construction | AI builds optimal portfolio automatically |

The AI-Powered Workflow

Modern goal-based construction eliminates manual "bucketing" and spreadsheet calculations:

Step 1: Input Spending Sequence

- Enter spending needs by year (e.g., Year 1: $120K, Year 2: $120K, Year 5: $50K for car)

- Paste directly from Excel or financial planning software

- Include one-time goals (home purchase, education, gifts)

- System automatically calculates total liquidity requirements

Step 2: AI Calculates Optimal Allocation

- Determines required liquid allocation to fund near-term spending

- Calculates optimal growth allocation for remaining assets

- Balances liquidity needs against growth potential

- Respects risk tolerance, accreditation level, and regulatory limits

Step 3: Custom Portfolio Generation

- AI builds portfolio using your firm's model portfolios

- Allocates across models to achieve target liquid/growth mix

- Ensures proper diversification and risk management

- Advisor can override allocations if needed

Key Insight: You don't manually assign assets to "buckets"—the AI automatically determines the optimal liquidity/growth split based on when clients need their money. This ensures sufficient liquid assets are always available while maximizing growth potential for long-term goals.

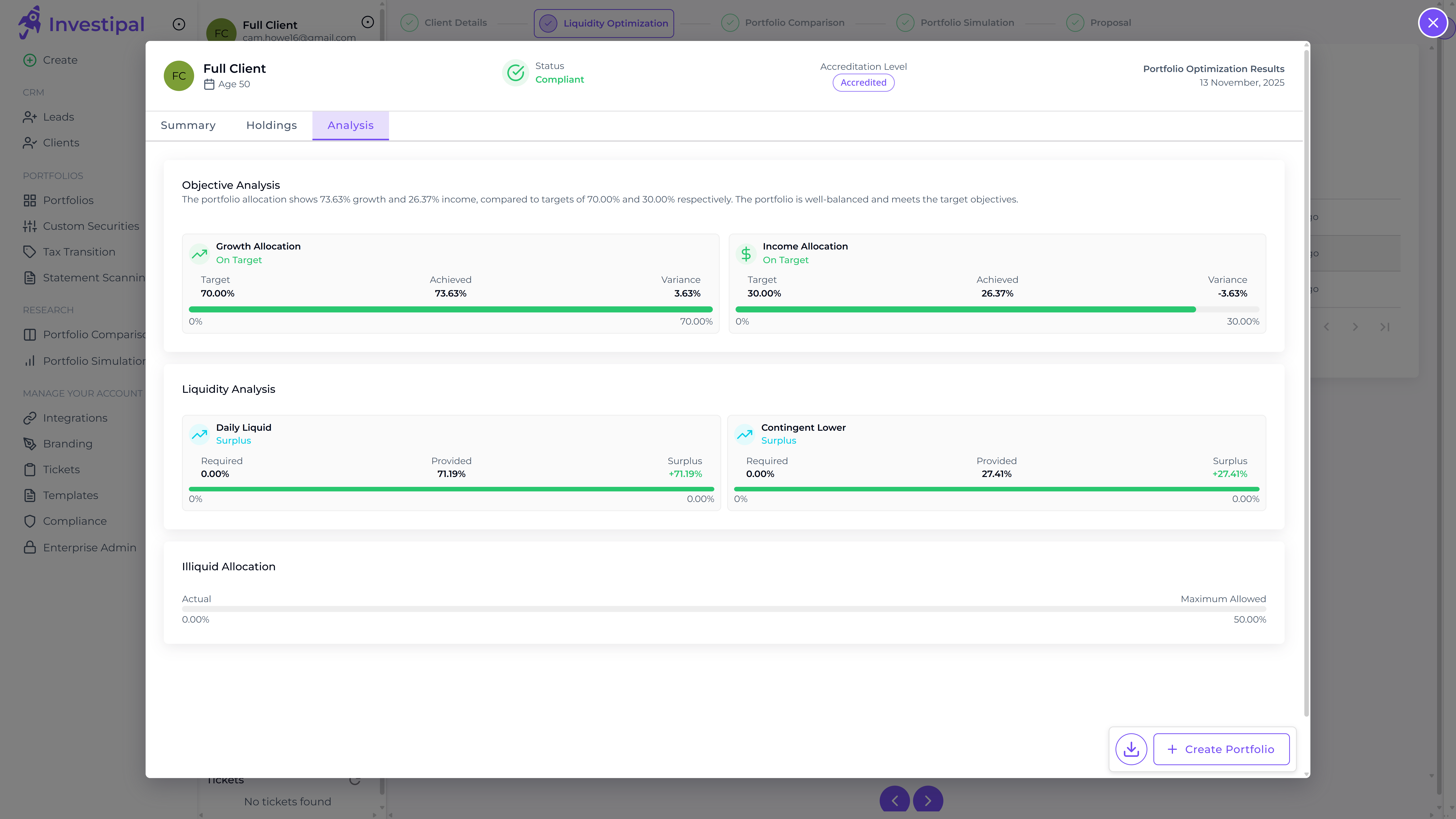

Objective Analysis view: See target vs. achieved metrics for growth allocation, income allocation, and liquidity requirements with visual progress indicators.

How Goal-Based Portfolio Construction Works in Practice

Modern AI-powered goal-based construction transforms what used to take hours in spreadsheets into a streamlined, automated workflow.

Step 1: Input Client Spending Sequence

Start by entering all spending needs and goals with their timing:

Annual Recurring Expenses:

- Year 1-30: $125,000/year (living expenses)

- Includes housing, healthcare, food, insurance, travel, discretionary

- Can adjust amounts by year if spending changes over time

One-Time Goals:

- Year 3: $75,000 (home renovation)

- Year 5: $50,000 (new car)

- Year 10: $100,000 (grandchild education)

- Year 20: $200,000 (vacation home down payment)

Input Methods:

- Enter directly in the platform

- Paste from Excel spreadsheet

- System automatically calculates total liquidity requirements

Total Portfolio: $2,500,000

Step 2: AI Analyzes and Optimizes

The system automatically processes your spending sequence and builds the optimal portfolio:

Liquidity Analysis:

- Calculates required liquid allocation for near-term spending (e.g., 71% liquid)

- Determines safe growth allocation for remaining assets (e.g., 74% growth-oriented)

- Ensures daily liquidity needs are met with surplus buffer

- Respects maximum illiquid allocation limits (e.g., 50% max)

Risk & Compliance Checks:

- Validates portfolio against client risk tolerance (e.g., Risk Score: 53)

- Ensures accreditation level requirements are met

- Checks suitability for Reg BI compliance

- Flags any conflicts or concerns

Portfolio Construction:

- AI allocates across your firm's investment universe (model portfolios or individual securities)

- Achieves target liquid/growth mix using optimal combinations

- Ensures proper diversification and risk management

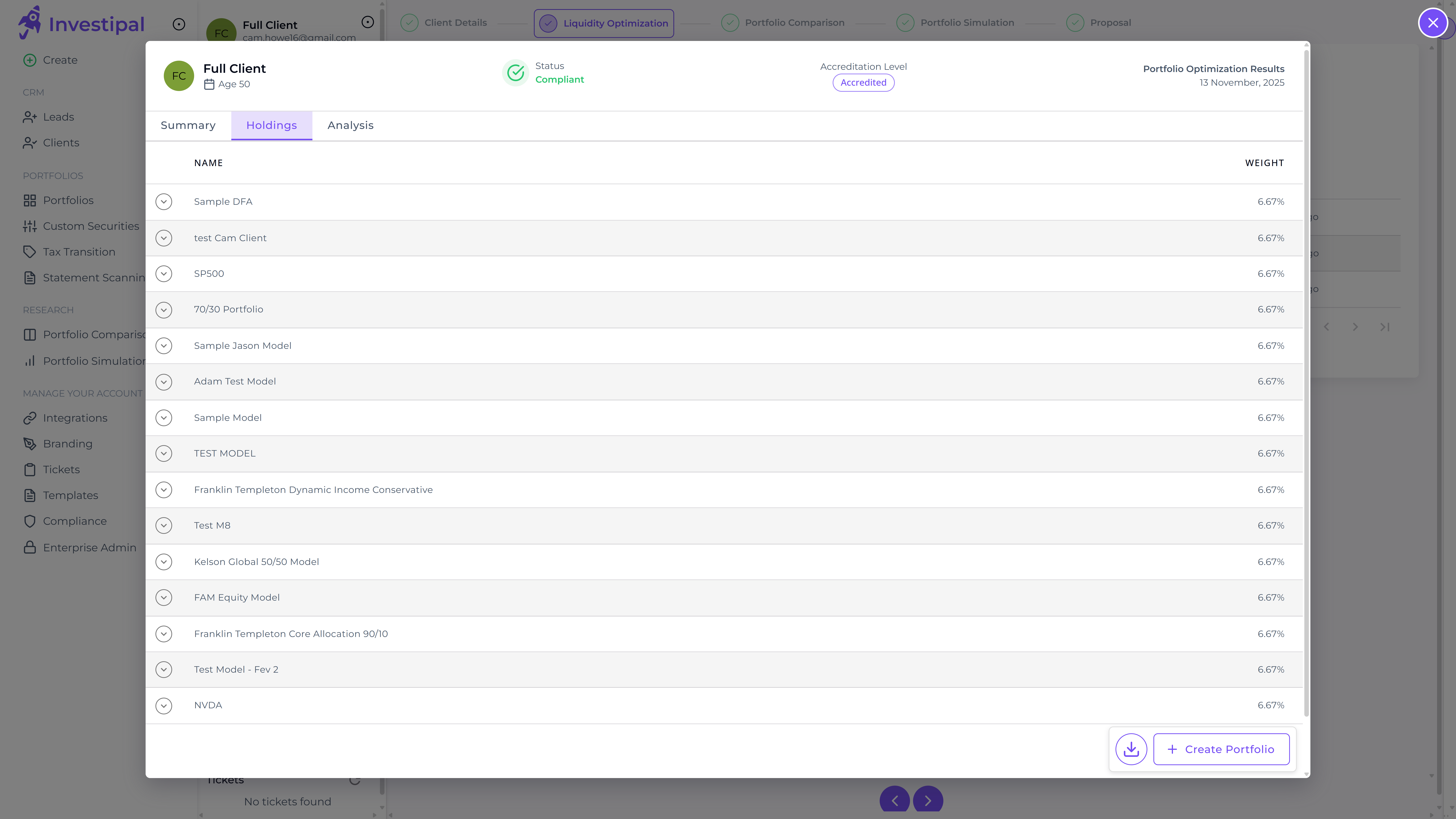

- Generates complete holdings breakdown with allocation weights

Step 3: Review and Customize (Optional)

The AI generates an optimized portfolio, but advisors maintain full control:

Review Results:

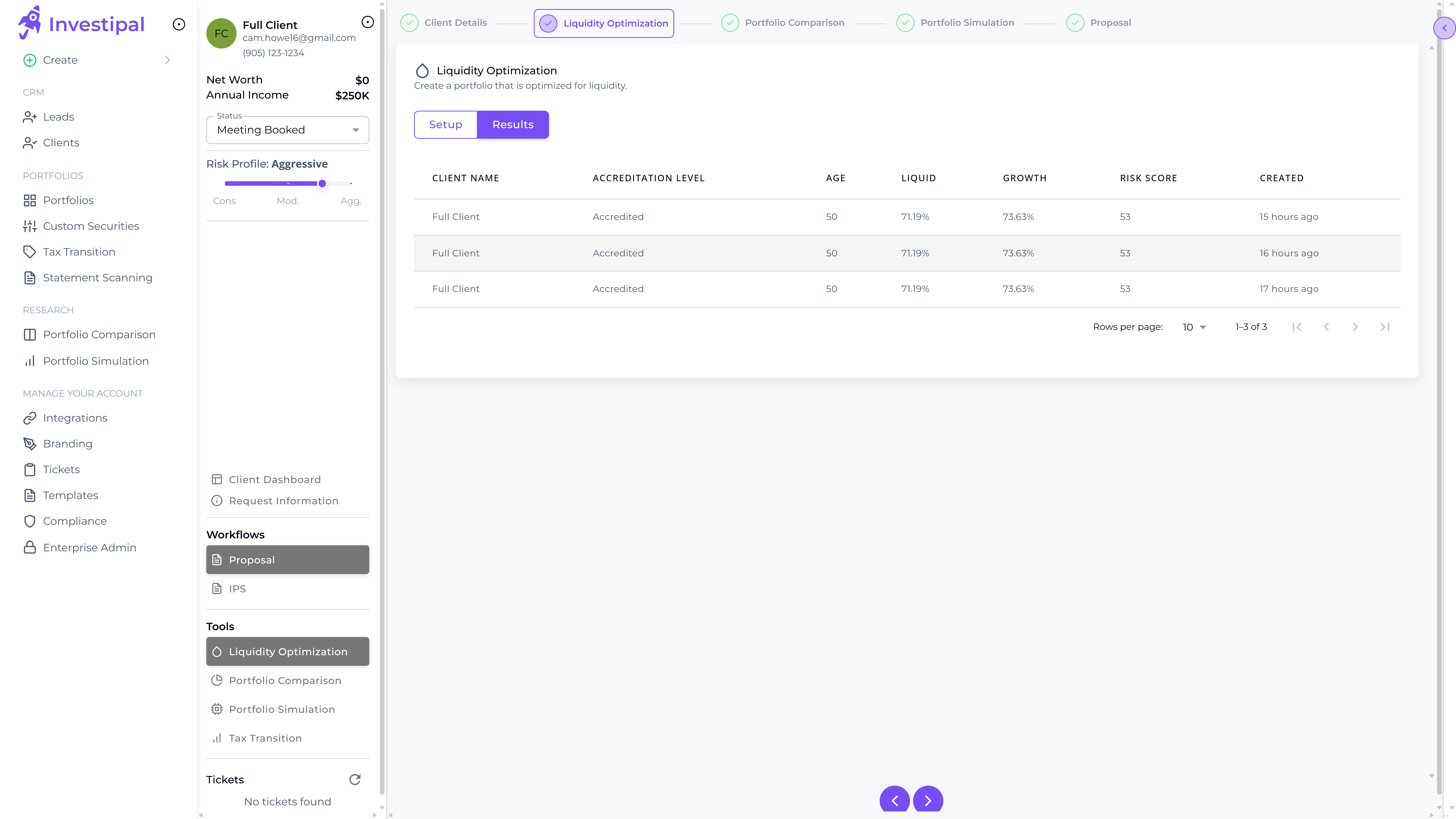

- Summary View: See total assets, liquid allocation, growth allocation, risk score

- Holdings View: Review all model portfolios and their weights

- Analysis View: Check objective analysis (growth/income targets), liquidity analysis (daily liquid, contingent), illiquid allocation

- Goal Status: Verify all goals are adequately funded

Override if Needed:

- Adjust model portfolio allocations manually

- Change liquid/growth target mix

- Add or remove specific holdings

- Modify risk constraints

- System recalculates and shows impact of changes

Modern goal-based portfolio construction software handles the complex optimization automatically, but gives advisors final say on all allocations.

Step 4: Monitor Goal-Funding Status

Unlike traditional rebalancing (which maintains fixed percentages), goal-based monitoring focuses on goal-funding status:

Ongoing Monitoring:

- Goal Coverage: Track which goals are fully funded, underfunded, or at risk

- Liquidity Status: Monitor whether liquid allocation still meets spending needs

- Risk Alignment: Ensure portfolio risk stays within target range

- Compliance Status: Verify ongoing suitability and regulatory compliance

Rebalancing Triggers:

- Goal-funding status changes (underfunded → at risk)

- Liquidity allocation drifts significantly from target

- Risk score exceeds tolerance limits

- Client spending needs change

- Major life events (inheritance, home sale, etc.)

Market Downturn Strategy:

- System shows you still have sufficient liquid assets for near-term needs

- Growth allocation can remain invested—no forced selling

- Goal-funding status helps clients stay calm during volatility

- Rerun optimization if needed to adjust to new market conditions

This AI-powered approach eliminates the panic-selling that destroys retirement portfolios during bear markets.

Holdings view: Complete breakdown of portfolio allocations across model portfolios with specific weights for each holding.

Goal-Based vs. Traditional Allocation: A Side-by-Side Comparison

Portfolio Structure

Traditional 60/40 Portfolio ($2.5M):

- Stocks: $1,500,000 (60%)

- Bonds: $1,000,000 (40%)

- Cash: $0 (must sell assets for expenses)

- Risk Score: 60 (generic)

- No liquidity analysis

AI-Optimized Goal-Based Portfolio ($2.5M):

- Liquid Allocation: 71% ($1,775,000) - Provides daily liquidity + buffer

- Growth Allocation: 74% ($1,850,000) - Optimized for long-term goals

- Risk Score: 53 (customized to client needs)

- Illiquid Allocation: 0% (max allowed: 50%)

- Allocated across 15 model portfolios at optimal weights

- Goal-funding status: All goals adequately funded

Note: Liquid and growth allocations can overlap—some liquid assets may also have growth characteristics (e.g., dividend stocks, balanced funds). The AI optimizes the intersection of liquidity and growth to maximize efficiency.

During a Market Crash (-30%)

Traditional Portfolio:

- Total portfolio drops to $1,750,000 (-30%)

- Must sell stocks at bottom to fund $125K expenses

- Client panics: "Should I move to all bonds?"

- Advisor struggles to explain why staying invested is right

- No visibility into which assets are "safe" vs. "at risk"

AI-Optimized Goal-Based Portfolio:

- System immediately shows: "71% liquid allocation unchanged—all near-term spending needs covered"

- Growth portion drops but client won't need that money for 5-10+ years

- Goal-funding dashboard shows: "Years 1-5 fully funded, Years 6-10 adequately funded"

- Client is calm: "The system shows I have enough liquid assets. Let's stay the course."

- No forced selling at the bottom—liquidity buffer prevents panic decisions

- Advisor can rerun optimization to show recovery scenarios

Client Communication

Traditional Approach:

"Your portfolio is down 30%, but historically markets recover. Stay the course."

Client thinks: "Easy for you to say—it's not your retirement!"

AI-Optimized Goal-Based Approach:

"Let me show you the goal-funding dashboard. See this? Your liquid allocation—71% of your portfolio—is completely protected and covers all your spending needs for the next 5 years. The growth portion that's down 30%? You won't need to touch that money for 10+ years. Markets have never failed to recover over 10-year periods. Your goals are still fully funded."

Client thinks: "I can see exactly what's safe and what has time to recover. I understand. I can sleep at night."

Goal-Based vs. Traditional: Two Different Investment Philosophies

The choice between goal-based construction and traditional allocation isn't about client age or portfolio size—it's about investment philosophy and what matters most to the client.

Traditional Allocation Philosophy:

- Risk-first approach: Portfolio built around risk tolerance score

- Market-relative thinking: Success measured against benchmarks (S&P 500, 60/40)

- Optimization goal: Maximize risk-adjusted returns

- Best for clients who: Care primarily about beating benchmarks, have simple needs, trust market-based strategies, don't have specific time-bound goals

Goal-Based Construction Philosophy:

- Goals-first approach: Portfolio built around specific spending needs and life goals

- Goal-relative thinking: Success measured by whether goals are funded

- Optimization goal: Maximize probability of achieving all goals

- Best for clients who: Have specific financial goals with deadlines, worry about running out of money, want to see "what's this money for?", need clarity during market volatility

Why This Matters:

A 35-year-old saving for a home down payment in 3 years, kids' college in 15 years, and retirement in 30 years benefits enormously from goal-based construction—even though they're decades from retirement. Similarly, a 70-year-old retiree with a pension covering all expenses and no specific goals might be perfectly fine with traditional allocation.

The determining factor isn't age or wealth—it's whether the client has specific, time-bound financial goals that matter more than beating the market. Goal-based construction answers "Will I achieve my goals?" while traditional allocation answers "Am I beating my benchmark?"

Practical Application: Many advisors use goal-based construction for any client with specific goals (home purchase, education, retirement income, legacy planning) and traditional allocation for clients focused on wealth accumulation without specific timelines. The sophistication of goal-based construction is justified when the answer to "When do you need this money and what for?" matters more than "What's your risk tolerance?"

Technology for Goal-Based Portfolio Construction

While the concept of goal-based construction is simple, the execution is complex. Managing multiple buckets, optimizing allocations, and rebalancing across time horizons requires sophisticated portfolio optimization software.

Why Excel Doesn't Scale

Many advisors start with spreadsheets, but quickly hit limitations:

- Manual Calculations: Updating bucket allocations for 50+ clients is time-consuming and error-prone

- No Optimization: Excel can't solve for optimal allocations across hundreds of constraints

- Poor Client Experience: Spreadsheets aren't client-facing; you need separate presentation materials

- Compliance Risk: Manual processes increase documentation errors and audit exposure

- No Integration: Data must be manually copied from custodian, CRM, and planning software

What to Look for in Financial Advisor Software for Goal-Based Construction

Modern AI-powered portfolio construction platforms should provide:

Core Optimization Engine:

- Spending-to-Liquidity Calculation: Automatically convert spending sequence into optimal liquid/growth allocation

- Multi-Constraint Optimization: Simultaneously optimize for liquidity needs, risk tolerance, growth/income targets, and regulatory requirements (accreditation, illiquid limits)

- Investment Universe Flexibility: Allocate across model portfolios OR individual securities from your firm's universe

- Real-Time Recalculation: Instantly show impact of any changes to spending, allocations, or constraints

Essential Output & Visualizations:

- Portfolio Summary: Clear overview of total assets, liquidity position, and allocation status

- Risk & Liquidity Dashboard: Single-view visualization showing risk score, liquid/growth split, and asset type breakdown

- Objective Tracking: Target vs. achieved metrics for growth, income, and liquidity requirements

- Compliance Monitoring: Accreditation validation, illiquid allocation limits, and suitability status

- Holdings Detail: Complete breakdown of portfolio allocations with weights and model assignments

- Goal-Funding Status: Clear indicators showing which goals are on track vs. at risk

- Actionable Recommendations: AI-generated insights on portfolio alignment and optimization opportunities

Compliance & Risk Management:

- Accreditation level validation

- Risk score calculation (weighted portfolio risk)

- Suitability checks for Reg BI compliance

- Automated recommendations based on optimization results

Advisor Control:

- Review AI-generated portfolios before implementation

- Override any allocation manually

- Adjust targets and constraints

- See impact of changes in real-time

How Investipal Automates Goal-Based Construction

Investipal's Goal-Based Portfolio Construction platform uses AI to transform spending needs into optimized portfolios automatically:

1. Simple Spending Input

- Enter spending needs by year (e.g., Year 1: $125K, Year 2: $125K, Year 5: $50K)

- Paste directly from Excel or financial planning software

- Include one-time goals (home purchase, education, gifts)

- No manual "bucketing" or asset assignment required

2. AI-Powered Liquidity Analysis

- System automatically calculates total liquidity requirements from spending sequence

- Determines optimal liquid allocation (e.g., 71% liquid)

- Calculates growth allocation for remaining assets (e.g., 74% growth)

- Ensures daily liquidity needs plus contingent buffer

- Respects maximum illiquid allocation limits (e.g., 50% max)

3. Custom Portfolio Optimization

- AI allocates across your firm's investment universe (model portfolios or individual securities)

- Optimizes for growth/income targets while maintaining required liquidity

- Validates against client risk tolerance and accreditation level

- Ensures compliance with suitability and Reg BI requirements

- Generates complete holdings breakdown with allocation weights

4. Comprehensive Results Dashboard

- Financial Overview: Total assets ($48K), available to invest ($0), emergency fund ($48K), cash reserve ($0) with visual allocation bar

- Liquidity Quadrant: Single visual showing risk score (53), liquid % (71%), growth % (74%), and income/growth/private/public split

- Summary: "Portfolio optimization completed. Allocated 100% across 15 model portfolios. Available to invest: $0. This optimization takes into account your liquidity needs, risk tolerance, and investment objectives."

- Allocation Strategy: "Successfully achieved target growth/income allocation of 70.0%/30.0%. The portfolio is well-balanced for the client's objectives."

- Risk Assessment: "Portfolio is compliant with Accredited Investor requirements. Illiquid allocation: 0.0% (max allowed: 50.0%). Weighted Portfolio Risk Score: 52.60"

- Liquidity Assessment: "Liquidity profile adequately matches client spending needs."

- Holdings View: Complete list with weights (e.g., Sample DFA 6.67%, SP500 6.67%, 70/30 Portfolio 6.67%...)

- Objective Analysis: Growth allocation (Target: 70%, Achieved: 73.63%, Variance: +3.63%) and Income allocation (Target: 30%, Achieved: 26.37%, Variance: -3.63%) with visual progress bars

- Liquidity Analysis: Daily Liquid (Required: 0%, Provided: 71.19%, Surplus: +71.19%) and Contingent Lower (Required: 0%, Provided: 27.41%, Surplus: +27.41%)

- Illiquid Allocation: Actual: 0.00%, Maximum Allowed: 50.00%

- Recommendations: "Portfolio optimization is well-suited to client needs"

5. Advisor Control & Overrides

- Review AI-generated portfolio and adjust if needed

- Change model allocations manually

- Modify liquid/growth targets

- System recalculates and shows impact of changes

- Export to professional proposal with one click

6. Ongoing Monitoring

- Track goal-funding status (fully funded, adequately funded, underfunded, at risk)

- Monitor liquidity coverage and risk alignment

- Get alerts when goals drift off track

- Rerun optimization when spending needs or market conditions change

Time Savings: What used to take 4-6 hours per client in Excel now takes 10-15 minutes with Investipal's AI-powered workflow. The system does the complex optimization automatically while giving advisors full control over final allocations.

Portfolio management view: Track goal-based portfolios across all clients with key metrics like liquid %, growth %, and risk scores at a glance.

Implementing Goal-Based Construction in Your Practice

Transitioning to goal-based portfolio construction requires both technical implementation and client communication strategy.

Technical Implementation Checklist

Phase 1: Pilot Program (1-2 months)

- Select 5-10 pilot clients: Choose retirees with clear spending needs and good relationships

- Document current portfolios: Gather all holdings, account statements, and current allocations

- Map spending needs: Interview clients to document essential expenses, discretionary goals, and one-time needs

- Build goal-based portfolios: Use software to create bucket allocations and optimized portfolios

- Present recommendations: Schedule review meetings to present new approach

- Implement and monitor: Execute trades and track results for 60-90 days

Phase 2: Firm-Wide Rollout (3-6 months)

- Train team: Ensure all advisors understand goal-based methodology

- Update IPS templates: Modify investment policy statements to reflect goal-based approach

- Create client communication materials: Develop one-pagers, videos, and presentation decks

- Segment client base: Identify which clients are best suited for goal-based construction

- Schedule transition meetings: Roll out systematically over 3-6 months

- Monitor and refine: Track client satisfaction, portfolio performance, and operational efficiency

Client Communication Strategies

Positioning the Transition:

"We're upgrading your portfolio strategy to better match your specific spending needs and goals. Instead of a one-size-fits-all allocation, we're building a customized plan that ensures you have cash when you need it and growth where you can afford to be patient."

Addressing Common Objections:

"Isn't this just market timing?"

Response: "No—we're not predicting when markets will go up or down. We're simply matching your money to when you'll need it. Your short-term money stays safe regardless of market conditions, and your long-term money has time to recover from any downturn."

"Why change what's working?"

Response: "Your current portfolio has served you well during accumulation. But retirement is different—you're now drawing down instead of contributing. Goal-based construction is specifically designed for this phase, reducing the risk of selling at the wrong time."

"Is this more expensive?"

Response: "The fee structure stays the same. We're simply organizing your portfolio more strategically. In fact, by reducing panic-selling during downturns, this approach typically improves long-term returns."

Presenting Goal-Based Portfolios

Visual Framework: Use a three-bucket diagram with clear labels:

- Bucket 1: "Your Safety Net" (0-3 years) - Green color

- Bucket 2: "Your Bridge" (3-10 years) - Yellow color

- Bucket 3: "Your Growth Engine" (10+ years) - Blue color

Key Talking Points:

- "You have 3 years of expenses in cash—completely protected from market swings."

- "Your medium-term money has 3-10 years to grow before you need it."

- "Your long-term money can stay fully invested because you won't touch it for 10+ years."

- "This eliminates the need to sell stocks during market crashes."

Compliance Considerations

Suitability & Reg BI:

- Document client spending needs, goals, and time horizons in writing

- Explain why goal-based construction is in the client's best interest

- Update IPS to reflect bucket strategy and rebalancing approach

- Maintain records of all client communications and approvals

Performance Reporting:

- Report performance at both bucket level and total portfolio level

- Use appropriate benchmarks for each bucket (not just S&P 500)

- Focus on goal progress, not just investment returns

- Disclose that past performance doesn't guarantee future results

Disclosure Requirements:

- Explain that bucket allocations are projections based on current spending needs

- Disclose that actual spending may differ from projections

- Note that portfolio construction software provides recommendations that require advisor review

- Include standard disclaimers about investment risk and no guarantees

The Future of Retirement Portfolio Management

Goal-based portfolio construction represents a fundamental shift in how advisors approach retirement planning. As the industry evolves, several trends are accelerating adoption:

Regulatory Pressure

Reg BI and fiduciary standards increasingly require advisors to demonstrate that recommendations are in the client's specific best interest—not just suitable based on generic risk profiles. Goal-based construction provides clear documentation of how portfolios match individual client needs.

Client Expectations

Modern retirees expect personalized strategies, not cookie-cutter solutions. Goal-based construction delivers the customization clients demand while remaining operationally efficient for advisors.

Technology Enablement

AI-powered portfolio construction platforms have made goal-based strategies accessible to advisors of all sizes. What once required a team of analysts can now be done by a solo advisor in minutes.

Competitive Differentiation

As robo-advisors commoditize traditional asset allocation, goal-based construction offers a clear competitive differentiator: "We don't just build portfolios based on risk scores—we match every dollar to your specific life goals."

Integration with Financial Planning

Goal-based construction bridges the gap between financial planning and investment management. Instead of separate planning and portfolio processes, they become one integrated workflow.

Frequently Asked Questions

What's the difference between goal-based investing and goal-based portfolio construction?

Goal-based investing is a broad philosophy of aligning portfolios with client goals. Goal-based portfolio construction is a specific implementation that uses liquidity bucketing and time-horizon matching to structure portfolios. Think of it as the "how" behind the "why."

Is goal-based construction the same as liability-driven investing (LDI)?

They're similar concepts with different origins. LDI comes from institutional pension management—matching assets to future pension liabilities. Goal-based construction applies the same principle to individual investors, matching assets to personal spending needs and life goals. The core idea is identical: match assets to future cash flow requirements.

How does the AI determine the right liquid/growth allocation for each client?

The AI analyzes your spending sequence input and automatically calculates the optimal liquid/growth split. It considers: (1) total liquidity requirements based on when money is needed, (2) client risk tolerance and accreditation level, (3) growth potential of remaining assets, (4) regulatory constraints (max illiquid allocation), and (5) your firm's model portfolio universe. The system balances ensuring sufficient liquidity for all goals while maximizing growth potential. Advisors can override the AI's recommendations if needed.

What if the client needs to take a large unexpected withdrawal?

The goal-funding dashboard shows you exactly which goals are funded and how much liquidity buffer exists. For unexpected needs, check: (1) if sufficient liquid allocation exists, take the withdrawal, (2) if markets are up, rerun the optimization to adjust for the new spending need, (3) if markets are down significantly and liquid allocation is tight, consider a short-term loan or line of credit to avoid selling growth assets at the bottom. The AI can instantly show you the impact of any withdrawal on goal-funding status.

How often should I rebalance goal-based portfolios?

Review annually at minimum, with quarterly check-ins. Monitor goal-funding status continuously—the system alerts you when goals drift from "fully funded" to "adequately funded" or "at risk." Rebalance when: (1) liquid allocation drifts significantly from target, (2) risk score exceeds tolerance limits, (3) spending needs change, or (4) major life events occur. Unlike traditional rebalancing (calendar-based), goal-based rebalancing is triggered by goal-funding status changes. You can rerun the AI optimization anytime to get updated recommendations.

Can I use goal-based construction for clients who are still working?

Yes, but it's most valuable for clients within 5-10 years of retirement or those with specific near-term goals (home purchase, education funding). For young accumulators with 20+ years until retirement, traditional allocation is usually simpler and sufficient. The complexity of goal-based construction is justified when time horizons become critical.

How do I handle required minimum distributions (RMDs) in a goal-based portfolio?

RMDs are predictable annual withdrawals, so include them in your Bucket 1 funding calculation. If RMDs exceed spending needs, you can either move excess to taxable accounts or adjust bucket sizes. Many advisors keep IRA assets in Buckets 2 and 3, taking RMDs from those buckets and moving them to Bucket 1 in taxable accounts.

What's the minimum portfolio size for goal-based construction to make sense?

There's no hard minimum, but the approach is most valuable for portfolios $500K+. Below that, clients often have limited flexibility and may need most assets in conservative allocations regardless. Above $1M, goal-based construction becomes essential for managing sequence risk and optimizing tax efficiency.

How do I explain this to clients who are used to traditional 60/40 portfolios?

Focus on the outcome, not the process: "Instead of building your portfolio around a generic risk score, we're building it around when you actually need your money. The AI analyzes your spending needs and automatically ensures you have enough liquid assets for near-term expenses while maximizing growth for long-term goals. You'll see exactly which goals are funded and which need adjustment—no more wondering if you'll run out of money." Show them the liquidity quadrant visual and goal-funding dashboard, which usually resonates immediately.

Does goal-based construction work with alternative investments?

Yes—the AI automatically accounts for illiquid alternatives when calculating optimal allocations. The system tracks your maximum illiquid allocation limit (e.g., 50%) and ensures sufficient liquid assets remain for all spending needs. Private equity, private credit, and real estate investments are factored into the growth allocation, but the AI ensures they don't compromise liquidity requirements. The analysis dashboard shows your actual vs. maximum illiquid allocation, so you always know your liquidity buffer. Learn more about managing alternative investments in client portfolios.

Start Building Goal-Based Portfolios Today

Goal-based portfolio construction isn't just a trend—it's the future of retirement planning. By matching assets to specific spending needs and time horizons, you can:

- Reduce client anxiety during market volatility

- Eliminate forced selling during downturns

- Improve long-term portfolio outcomes

- Differentiate your practice from competitors

- Meet higher fiduciary and Reg BI standards

The shift from "What's your risk tolerance?" to "When do you need this money?" represents a fundamental improvement in how advisors serve retirees.

Ready to see how goal-based portfolio construction works in practice? Explore Investipal's Goal-Based Portfolio Construction platform and discover how AI-powered automation can help you build better retirement portfolios in minutes, not hours.

See Goal-Based Construction in Action →

Disclaimer: This content is for educational purposes only and does not constitute investment advice. Goal-based portfolio construction is a methodology that requires professional implementation and ongoing management. Past performance does not guarantee future results. All investment strategies involve risk, including possible loss of principal. Advisors should ensure any portfolio construction approach complies with applicable regulations and is suitable for each individual client's circumstances.

.png)

.png)