The financial advisory industry has a speed problem.

While prospects expect Amazon-level responsiveness, the average advisor still takes 1 to 6 weeks to move from initial meeting to proposal delivery. For simple accounts, it’s 1-2 weeks. For moderate complexity clients with multiple accounts, 2-3 weeks. For high-net-worth clients with trusts or complex holdings, 4-6 weeks or longer.

Meanwhile, the top-performing advisors in 2025 are completing this entire workflow in under 10 minutes—and closing deals in the first meeting.

This isn’t about cutting corners or sacrificing quality. It’s about leveraging integrated workflow automation that eliminates bottlenecks while maintaining (and often improving) compliance standards.

Here’s how the financial advisor workflow is being revolutionized, and what you need to know to compete in 2025.

Table of Contents

- The Hidden Cost of Slow Proposals

- The Traditional Workflow: Where Time Disappears

- The New 10-Minute Workflow: How Top Advisors Do It

- The Technology That Makes It Possible

- Real-World Impact: What Changes When You Automate

- What to Look For in a Workflow Automation Platform

- How Investipal Delivers the 10-Minute Workflow

- Getting Started: Your Implementation Roadmap

- The Competitive Advantage of Speed

- Frequently Asked Questions

The Hidden Cost of Slow Proposals

Before we dive into the solution, let’s quantify what slow proposal workflows are actually costing your firm.

Lost Deals

Studies show that prospect engagement drops significantly after 48 hours from the initial meeting, with some research suggesting engagement can decline by 50% or more. The longer you take to deliver a proposal, the colder the prospect becomes. Competitors who can deliver same-day proposals have a massive advantage.

According to the 2025 Schwab RIA Benchmarking Study, firms that close prospects faster see 16.6% AUM growth compared to just 12.1% for firms with slow, manual workflows.

Opportunity Cost

If creating a single proposal consumes 8-15 hours of advisor time (spread across data gathering, analysis, creation, and compliance review), that’s time you can’t spend on:

- Prospecting for new clients

- Serving existing clients

- Building strategic relationships

- Growing your business

For an advisor billing at $200/hour, those 15 hours represent $3,000 in opportunity cost per proposal—whether the prospect converts or not.

Capacity Constraints

Manual workflows limit how many proposals you can realistically create per month. If each proposal takes 15 hours and you work 160 hours/month, your maximum capacity is just 10-11 proposals per month—and that assumes you do nothing else.

This capacity constraint is one of the biggest bottlenecks in wealth management sales that prevents firms from scaling efficiently.

Automated workflows that compress proposals to 10 minutes expand your capacity to 50-100+ proposals per month with the same resources.

Client Experience

Today’s clients expect digital-first experiences. They’re accustomed to instant results from technology in every other area of their lives. When your proposal process feels slow and outdated, it raises questions about your firm’s capabilities and modernization.

78% of clients now expect interactive digital experiences from their financial advisors, according to Schwab’s research. Meeting these expectations requires workflow automation.

The Traditional Workflow: Where Time Disappears

Let’s break down where time is actually spent in traditional advisor workflows:

Step 1: Manual Data Entry from Statements (3-5 hours)

The typical process:

- Prospect emails PDF statements from multiple custodians

- Advisor manually transcribes holdings, ticker symbols, quantities, cost basis, and transaction history into spreadsheets or portfolio management software

- Data is prone to transcription errors that require reconciliation (creating NIGOs that cost your firm)

- Multi-account clients with 5-10 statements multiply this time exponentially

Time consumed: 3-5 hours per client

Step 2: Risk Assessment & Suitability Analysis (30-60 minutes)

Traditional approach:

- Schedule separate meeting or send email questionnaire

- Wait for client to complete and return (adds days)

- Manually score responses

- Document risk tolerance in client file

- Match risk profile to appropriate portfolio models

Time consumed: 30-60 minutes, plus days of waiting

Step 3: Portfolio Design & Analysis (2-3 hours)

The portfolio construction process:

- Research appropriate securities and allocations

- Build proposed portfolio in Excel or portfolio software

- Calculate risk metrics, expense ratios, tax efficiency

- Compare current portfolio vs. proposed portfolio

- Create allocation charts and performance projections

- Run scenario analysis or Monte Carlo simulations

Time consumed: 2-3 hours

Step 4: Proposal Creation (2-4 hours)

Assembling the proposal:

- Pull data from multiple sources (portfolio software, CRM, market data)

- Create charts and visualizations in PowerPoint or Word

- Write narrative explanations

- Format and brand the document

- Proofread for errors

- Export to PDF

Time consumed: 2-4 hours

Step 5: Compliance Documentation (1-2 hours)

Meeting regulatory requirements:

- Draft Investment Policy Statement (IPS)

- Document best-interest analysis for Reg BI

- Create suitability documentation

- Include all required disclosures

- Submit for compliance review (adds more days)

Time consumed: 1-2 hours, plus compliance review delays

Total Traditional Time: 8-15+ Hours (Spread Over 1-6 Weeks)

This assumes everything goes smoothly—no missing data, no errors requiring rework, no compliance issues requiring revisions.

In reality, most proposals take even longer due to:

- Back-and-forth with prospects to gather missing information

- Errors in manual data entry requiring reconciliation

- Compliance rejections requiring revisions

- Scheduling challenges for follow-up meetings

Bottom line: The traditional workflow is unsustainable for firms that want to grow.

The New 10-Minute Workflow: How Top Advisors Do It

Here’s how leading advisors in 2025 are compressing weeks of work into a single 10-minute workflow—typically completed during or immediately after the initial client meeting.

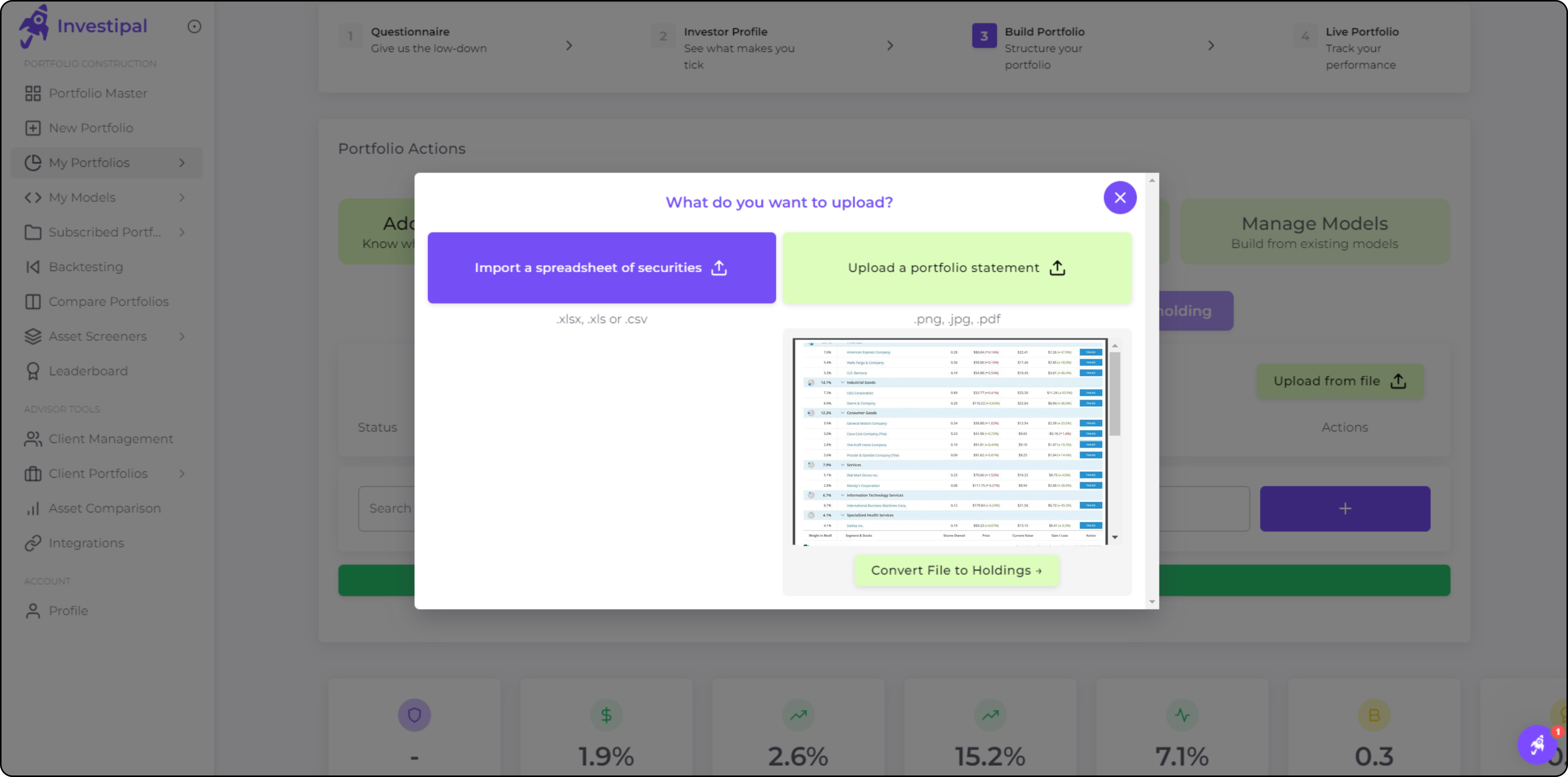

Minutes 0-2: AI-Powered Statement Scanning

Technology: Advanced OCR (Optical Character Recognition) with machine learning

Process:

- Prospect shares PDF statements from any custodian (Schwab, Fidelity, Vanguard, Interactive Brokers, etc.)

- AI-powered automated statement scanner instantly extracts:

- All holdings (ticker symbols, quantities, current values)

- Cost basis and unrealized gains/losses

- Transaction history

- Account types and tax treatment

- Fees and expense ratios

- Data is automatically organized and validated

What used to take 3-5 hours now takes 2 minutes.

Investipal’s statement scanner supports 50+ custodian formats and achieves 99%+ accuracy on structured data extraction, depending on statement quality.

Investipal’s automated statement scanner processes documents from 50+ custodians instantly

Investipal’s automated statement scanner processes documents from 50+ custodians instantly

Minutes 2-4: Automated Risk Assessment

Technology: Dynamic risk questionnaires with intelligent scoring

Process:

- Digital risk questionnaire is sent via client portal or completed in meeting

- AI scores responses in real-time

- Risk tolerance is automatically mapped to appropriate portfolio strategies

- Results flow directly into portfolio recommendations (no manual data transfer)

- Full documentation is created automatically for compliance

What used to take 30-60 minutes (plus days of waiting) now takes 2 minutes.

Modern risk assessment tools also track changes over time, alerting you when a client’s risk tolerance shifts and portfolios need adjustment.

Minutes 4-7: AI Portfolio Analysis & Comparison

Technology: AI-driven portfolio analysis engine

Process:

- AI instantly analyzes current portfolio (from statement scan) against client’s risk profile

- Identifies issues: excessive fees, poor diversification, concentrated risk, tax inefficiencies

- Provides data-driven insights to help advisors build optimal recommendations

- Creates side-by-side comparison showing:

- Current vs. proposed asset allocation

- Fee comparison (potential savings)

- Risk metrics (Sharpe ratio, standard deviation, beta)

- Tax impact analysis

- Projected performance scenarios

What used to take 2-3 hours now takes 3 minutes.

Side-by-side portfolio comparison with risk metrics, fee analysis, and performance projections

Side-by-side portfolio comparison with risk metrics, fee analysis, and performance projections

The AI analyzes multiple factors to help advisors make informed decisions:

- Risk-adjusted returns (Sharpe ratio, volatility analysis)

- Tax efficiency (capital gains implications, asset location opportunities)

- Cost efficiency (expense ratios, trading costs, fee drag)

- Diversification (concentration risk, correlation analysis)

- Goal alignment (time horizon, objectives, constraints)

The advisor remains in control—AI provides the analysis, you make the final portfolio decisions. For complex clients with alternative investments, the system can model private equity, real estate, annuities, and structured products alongside traditional securities.

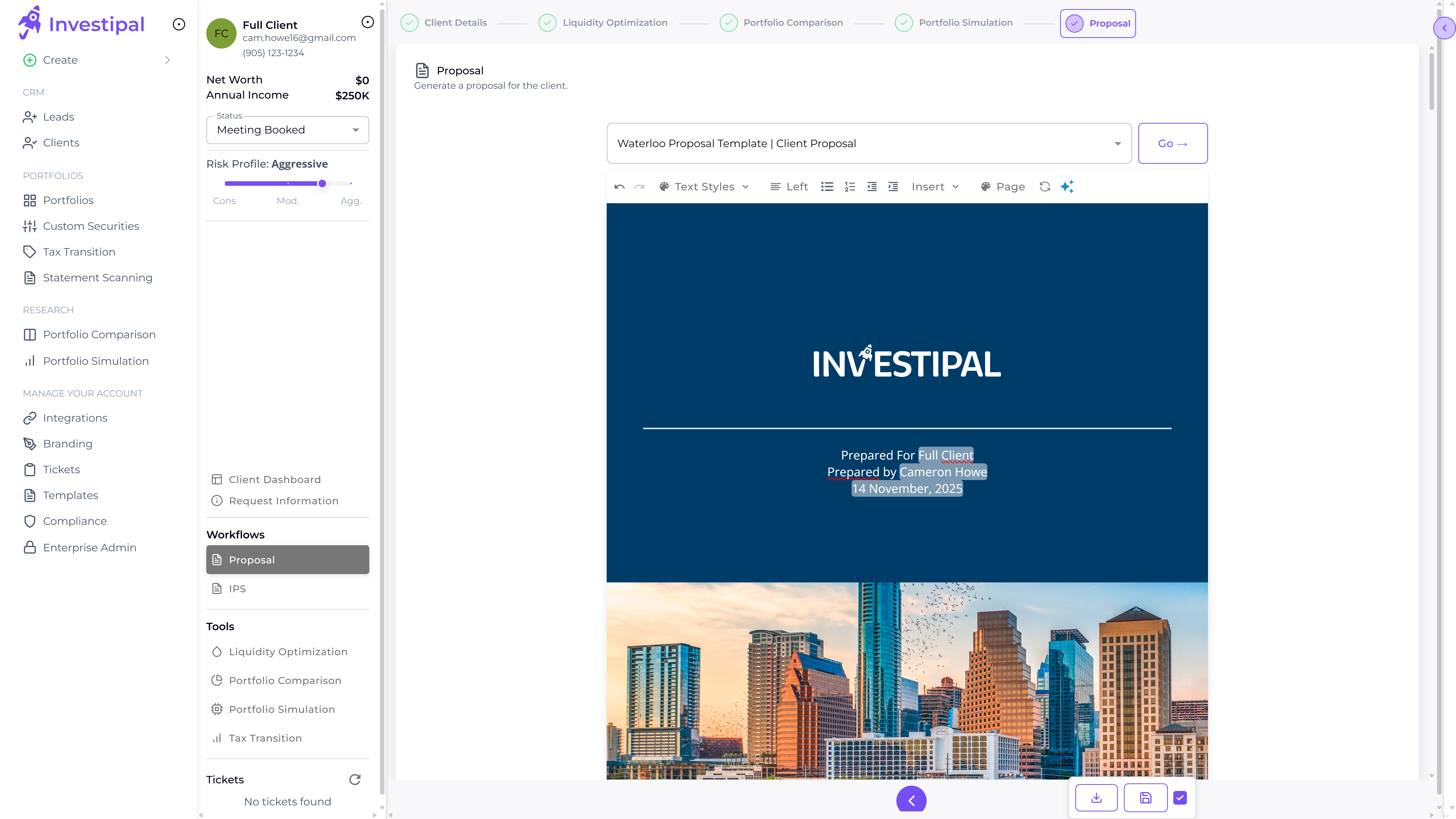

Minutes 7-9: Proposal Generation with Visualizations

Technology: Automated proposal builder with branded templates

Process:

- All data from previous steps flows automatically into proposal template

- AI generates:

- Executive summary with key recommendations

- Current portfolio analysis with identified issues

- Proposed portfolio with clear rationale

- Professional charts and visualizations

- Performance projections and Monte Carlo analysis

- Fee comparison and potential savings

- Tax transition analysis

- Advisor customizes messaging and adds personal touches

- Branded, client-ready PDF is generated

What used to take 2-4 hours now takes 2 minutes.

Branded investment proposal with portfolio analysis and performance projections

Branded investment proposal with portfolio analysis and performance projections

Modern proposal tools also support:

- White-label branding (your logo, colors, fonts)

- Interactive proposals (clients can adjust assumptions)

- Video presentations (recorded explanations embedded in proposal)

- Client portal delivery (secure, trackable sharing)

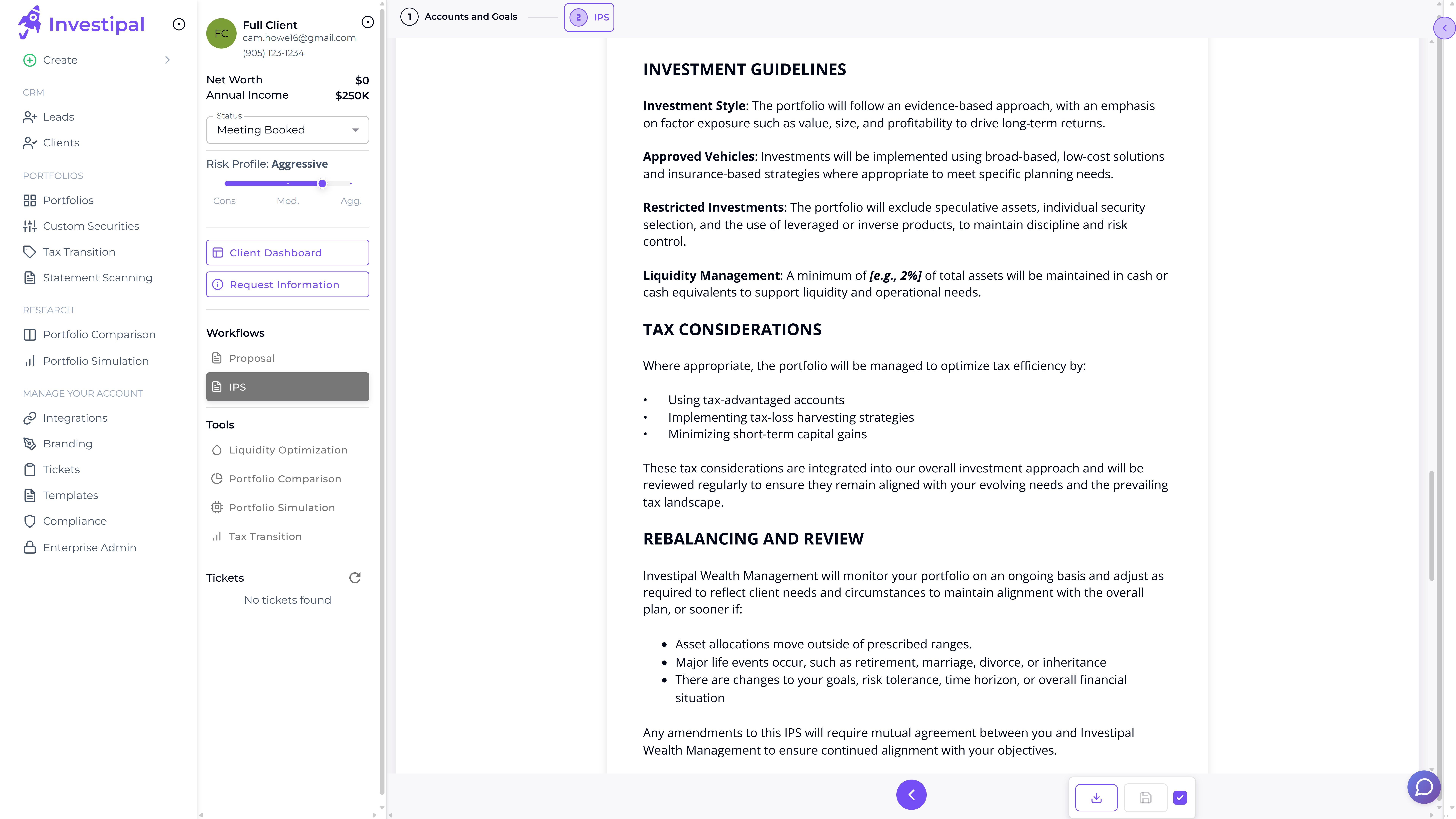

Minutes 9-10: Auto-Generated Compliance Documentation

Technology: Compliance automation engine

Process:

- Investment Policy Statement (IPS) is automatically generated based on:

- Client objectives and constraints

- Risk tolerance assessment

- Recommended portfolio strategy

- Rebalancing guidelines

- Reg BI documentation is created automatically:

- Best interest analysis

- Reasonable alternatives considered

- Conflict of interest disclosures

- Material limitations disclosure

- All required regulatory disclosures are included

- Complete audit trail is captured

What used to take 1-2 hours now takes 1 minute.

Automatically generated Investment Policy Statement with full Reg BI documentation

Automatically generated Investment Policy Statement with full Reg BI documentation

Compliance automation ensures:

- Consistency across all client documentation

- Completeness of regulatory requirements

- Accuracy of disclosures and calculations

- Audit readiness with full documentation trail

Total New Workflow Time: Under 10 Minutes

From statement upload to compliant, branded proposal with full IPS and Reg BI documentation.

This isn’t theory. This is how top advisors are operating in 2025.

The Technology That Makes It Possible

The 10-minute workflow isn’t about a single tool—it’s about integrated workflow automation that connects every step seamlessly.

Why Integration Matters

Many advisors attempt to “automate” by stitching together point solutions:

- One tool for statement scanning

- Another for risk assessment

- A third for portfolio management

- A fourth for proposal generation

- A fifth for compliance documentation

The problem: Data doesn’t flow between systems. You’re still manually re-entering information, which reintroduces errors and time waste.

The firms achieving 10-minute workflows use all-in-one platforms where:

- Data enters once (statement scan) and flows through the entire workflow

- Each step automatically feeds the next

- No manual data transfer or reconciliation needed

- Single source of truth for all client information

Core Technologies Enabling Fast Workflows

1. AI-Powered OCR and Data Extraction

Modern OCR doesn’t just scan text—it understands financial documents:

- Recognizes different custodian statement formats automatically

- Extracts structured data (not just text)

- Validates data for completeness and accuracy

- Handles scanned images and native PDFs equally well

Typical accuracy: 99%+ for structured financial data

Learn more about AI statement scanning

2. AI-Powered Portfolio Analysis & Comparison

AI-driven analysis tools help advisors make better portfolio decisions faster:

- Instant side-by-side comparison of current vs. proposed portfolios

- Multi-factor analysis (risk, return, cost, tax efficiency)

- Real-time market data integration

- Support for alternative assets and complex securities

- Human-in-the-loop approach: AI handles the analysis, advisors make the final decisions

The technology analyzes thousands of data points to highlight:

- Tax implications of portfolio transitions

- Trading costs and implementation practicality

- Portfolio concentration risks and diversification opportunities

- Fee savings opportunities

3. Natural Language Generation

AI writes proposal narratives automatically:

- Explains portfolio recommendations in plain English

- Highlights key differences between current and proposed portfolios

- Generates personalized commentary based on client circumstances

- Maintains consistent, professional tone

Advisors can review and customize the AI-generated text, but the heavy lifting is automated.

4. Compliance Rules Engines

Automated compliance systems encode regulatory requirements:

- Reg BI best interest standards

- SEC and FINRA disclosure requirements

- State-specific regulations

- Firm-specific policies and procedures

The system ensures every proposal includes required documentation and disclosures, reducing compliance risk.

5. Integrated Workflow Orchestration

The “glue” connecting all these technologies:

- Manages data flow between components

- Tracks progress through multi-step workflows

- Handles error conditions gracefully

- Provides real-time status visibility

Think of it as an assembly line for proposals—each station performs its specialized task, passing work seamlessly to the next station.

Real-World Impact: What Changes When You Automate

Beyond the obvious time savings, workflow automation transforms how your firm operates:

1. Close Clients in the First Meeting

Traditional: “I’ll analyze your portfolio and get back to you in a week or two.”

Automated: “Let me pull up your analysis right now. Here’s what I’m seeing…”

Being able to deliver proposals in the initial meeting (or within 24 hours) dramatically increases conversion rates. The prospect’s interest is highest when they’re sitting across from you. Strike while the iron is hot.

This approach transforms your client acquisition process from weeks-long campaigns to same-day closings.

Conversion rate improvements: 25-40% higher close rates when proposals are delivered same-day vs. same-week.

2. 5-10x Capacity Increase

If proposals take 10 minutes instead of 15 hours, you can realistically create 90x more proposals with the same resources.

In practice, firms typically see 5-10x capacity increases because:

- You still spend time in initial client meetings

- Some proposals require additional customization

- You focus on higher-quality prospects

But even 5x capacity is transformational. If you were previously limited to 10 proposals per month, you can now handle 50+.

3. Better Client Experience

Fast proposals feel like magic to clients:

- Professionalism: Sophisticated, branded proposals convey competence

- Responsiveness: Same-day delivery shows you value their time

- Transparency: Clear visualizations help clients understand recommendations

- Convenience: Digital delivery makes proposals easy to review and share

According to research from Docupace, firms with streamlined digital onboarding report 20-30% higher client satisfaction scores.

4. Higher Revenue Per Advisor

More proposals with higher conversion rates = more closed business.

Example:

-

Before automation:

- 10 proposals/month

- 30% close rate

- 3 new clients/month

- $500K average AUM

- $1.5M new AUM/month

-

After automation:

- 50 proposals/month

- 40% close rate (faster delivery improves close rate)

- 20 new clients/month

- $500K average AUM

- $10M new AUM/month

At a 1% fee, that’s an additional $85,000 in annual revenue per advisor.

5. Reduced Compliance Risk

Manual processes are error-prone. Automated compliance documentation ensures:

- All required disclosures are included

- Best interest analysis is documented consistently

- Suitability standards are met

- Complete audit trails exist

Compliance violations cost $50,000-$500,000 on average when you factor in fines, legal fees, and remediation costs. Automation dramatically reduces this risk.

6. Happier, More Productive Teams

Advisors didn’t get into financial planning to spend hours on data entry and document formatting. Automation lets them focus on high-value activities:

- Building client relationships

- Strategic financial planning

- Business development

- Professional development

Result: Higher job satisfaction, lower turnover, better retention of top talent.

What to Look For in a Workflow Automation Platform

Not all “automation” solutions deliver the 10-minute workflow. Here’s what to evaluate:

1. True End-to-End Integration

Question to ask: “Does data flow automatically from statement scanning through to final proposal, or do I need to manually transfer information between steps?”

Red flag: Platforms that require manual data exports/imports between modules.

What to look for: Single database where data enters once and flows through the entire workflow automatically.

2. AI-Powered Automation (Not Just Templates)

Question to ask: “Does the platform use AI to analyze portfolios and generate recommendations, or do I still need to do the analysis manually?”

Red flag: “Automation” that just means “templates” or “form filling.”

What to look for:

- AI portfolio optimization

- Automated risk analysis

- Intelligent document generation

- Natural language proposal writing

3. Built-In Compliance, Not Bolt-On

Question to ask: “Are compliance features integrated into the workflow, or are they separate tools I need to use afterwards?”

Red flag: Compliance as an afterthought or separate module.

What to look for:

- Compliance automation that runs automatically during proposal creation

- Real-time validation of regulatory requirements

- Automatic IPS and Reg BI documentation generation

4. Speed Benchmarks (Not Vague Claims)

Question to ask: “What’s the actual time from statement upload to final proposal for a typical client?”

Red flag: Vendors who won’t provide specific time benchmarks.

What to look for:

- Concrete time claims (e.g., “under 10 minutes”)

- Demo videos showing actual workflow timing

- Customer testimonials with specific time savings

5. White-Label Customization

Question to ask: “Can I fully customize proposals with my branding, or will they look generic?”

Red flag: Proposals with vendor branding or limited customization options.

What to look for:

- Full branding control (logos, colors, fonts)

- Customizable proposal sections and layouts

- Ability to add custom commentary and recommendations

6. Support for Complex Scenarios

Question to ask: “Can the platform handle alternative investments, annuities, and complex securities, or is it limited to stocks and bonds?”

Red flag: Systems that only support traditional public equities.

What to look for:

- Multi-asset class support (alternatives, private equity, real estate, annuities)

- Custom security modeling

- Tax transition analysis

- Flexible portfolio construction tools

7. Transparent, Scalable Pricing

Question to ask: “What’s the total monthly cost, and are there hidden fees or long-term contracts?”

Red flag:

- Multi-year lock-ins

- Per-proposal fees that make high volume expensive

- Hidden charges for “premium” features you need

What to look for:

- Clear monthly subscription pricing

- Unlimited or high proposal limits

- Ability to scale as you grow

- No long-term commitments

How Investipal Delivers the 10-Minute Workflow

At Investipal, we built our platform specifically to enable the complete workflow in under 10 minutes:

Integrated Workflow Components

1. AI-Powered Statement Scanner

- Supports 50+ custodian formats

- 99%+ accuracy on data extraction

- Processes statements in seconds

- Automatically validates and organizes data

- Automated risk questionnaires

- E-signature integration

- Document collection workflows

- AML/KYC verification

3. AI Portfolio Analysis & Construction

- Multi-asset class support (including alternatives)

- Risk-based and goal-based portfolio construction

- Tax-aware portfolio analysis

- Human-in-the-loop: AI analyzes, advisors decide

4. Automated Proposal Generation

- Professional, branded proposals

- Clear visualizations and charts

- Side-by-side portfolio comparisons

- Performance projections and Monte Carlo analysis

- Auto-generated Investment Policy Statements

- Reg BI best interest documentation

- Complete regulatory disclosures

- Full audit trail

Everything Flows Seamlessly

- Data enters once (statement scan) and flows through entire workflow

- No manual data transfer between steps

- No switching between platforms or tools

- Single source of truth for all client information

Getting Started: Your Implementation Roadmap

Ready to implement workflow automation? Here’s your 30-day roadmap:

Week 1: Audit Your Current Workflow

Action items:

- Time each step of your current proposal process

- Document pain points and bottlenecks

- Calculate opportunity cost (hours × billing rate)

- Identify compliance challenges

Deliverable: Current state workflow map with time measurements

Week 2: Evaluate Platforms

Action items:

- Request demos from 2-3 platforms

- Test statement scanning with your custodians’ formats

- Review sample proposals for quality and branding

- Verify compliance features meet your requirements

- Get pricing and contract terms

Deliverable: Platform comparison matrix with pros/cons

Week 3: Pilot Testing

Action items:

- Select one platform for pilot

- Set up your firm’s branding and templates

- Process 5-10 test proposals

- Measure actual time savings

- Get team feedback

Deliverable: Pilot results with time savings quantified

Week 4: Full Implementation

Action items:

- Train all advisors on the platform

- Document your new streamlined workflow

- Update client-facing processes

- Communicate changes to compliance team

- Begin using for all new prospects

Deliverable: Fully operational automated workflow

The Competitive Advantage of Speed

In 2025, speed is a competitive weapon.

While your competitors are still telling prospects “I’ll get back to you in a week or two,” you’re delivering comprehensive, compliant proposals in the first meeting.

While they’re manually transcribing brokerage statements, you’re using that time to build relationships and close more business.

While they’re limited to 10-15 proposals per month, you’re handling 50-100+ with the same team.

Workflow automation isn’t about working harder—it’s about working smarter.

The technology exists today to compress weeks of proposal work into minutes. The question is: will you adopt it and gain a competitive edge, or will you stick with manual processes and watch faster competitors win your prospects?

Conclusion: The Future is Fast

The financial advisory industry is splitting into two camps:

Camp 1: Firms that embrace integrated workflow automation, deliver proposals in minutes, close deals faster, and scale efficiently.

Camp 2: Firms that cling to manual processes, take weeks to deliver proposals, lose deals to faster competitors, and struggle to grow.

Which camp will you be in?

The 10-minute workflow isn’t a future vision—it’s happening right now. Top advisors are already operating this way, and they’re capturing market share from slower competitors.

The good news: you don’t need to build this technology yourself. Platforms like Investipal have done the heavy lifting of integrating AI statement scanning, portfolio optimization, proposal generation, and compliance automation into a seamless workflow.

The barrier to entry is lower than ever. The only question is: how quickly will you act?

Take the Next Step

See the 10-minute workflow in action. Book a personalized demo and we’ll show you:

✅ How AI scanning extracts data from your custodians’ statements

✅ How portfolio optimization works with your investment philosophy

✅ How proposals are generated with your branding

✅ How compliance documentation is created automatically

Book your demo today and discover how workflow automation can transform your practice.

Frequently Asked Questions

How accurate is AI-powered statement scanning?

Modern AI-powered OCR achieves 99%+ accuracy on structured financial data from PDF statements. The technology can read both native PDFs and scanned images, and it automatically validates data for completeness. Any potential issues are flagged for human review.

Will automation make proposals feel impersonal?

Actually, the opposite. Automation handles the tedious data entry and formatting, freeing you to focus on what matters: building relationships and providing personalized advice. Proposals are fully customizable with your commentary, and the time savings let you spend more face-to-face time with clients.

How does this work with alternative investments or complex securities?

Leading platforms like Investipal support multi-asset class portfolios including alternatives (private equity, real estate, hedge funds), annuities, and structured products. You can model custom securities that don’t have standard market data.

What about compliance and regulatory requirements?

Integrated platforms automatically generate Investment Policy Statements, Reg BI documentation, and required disclosures based on the client’s specific situation. Everything is documented for audit purposes, actually reducing compliance risk compared to manual processes.

Is this technology expensive?

Platforms typically cost $250-$1,200/month depending on firm size and features. Given that each proposal represents $50,000-$5M+ in potential AUM, the ROI is immediate. Plus, time savings often exceed the software cost in the first month alone.

How long does implementation take?

Most firms are up and running within 2-4 weeks. This includes setup, branding customization, team training, and pilot testing. The modern cloud-based platforms require no IT infrastructure or complex installations.

Can I still customize proposals for unique client situations?

Absolutely. Automation handles the foundation (data extraction, analysis, compliance docs), but you maintain full control over recommendations, commentary, and customization. Think of it as having a highly skilled assistant handle the grunt work while you focus on strategy.

What if a client has statements from multiple custodians?

The best platforms can process statements from any custodian (Schwab, Fidelity, Vanguard, TD Ameritrade, Interactive Brokers, etc.) and automatically consolidate holdings into a unified view. This is actually where automation provides the biggest time savings—scenarios that would take hours manually take minutes with AI.

Related Articles:

- The Ultimate Guide to Financial Advisor Proposal Generation Software in 2025

- 4 Steps to Automate Your Client Onboarding Workflow and Win More Clients

- How to Extract Account Statement Portfolio Holdings from PDFs Using AI

- Understanding Regulation Best Interest (Reg BI): Essential Guide for Financial Advisors

- 5 Common Bottlenecks in Financial Advisor Sales and How to Fix Them

- Investipal vs Nitrogen: Complete Workflow Comparison

- How AI-Driven Risk Profiling is Transforming Financial Planning

- Understanding NIGOs: Why They’re Costing Your Firm

.png)